Margins as a Measurement of Management - - The “M” in CAMEL

IDC Financial Publishing, Inc. (IDCFP) uses the acronym CAMEL and its component financial ratios to evaluate the safety and soundness of commercial banks and savings institutions. This article explains how IDCFP uses margins as a component of its CAMEL ranking system and why it is valuable and important to monitor.

The key Margins that Measure Management include Return on Equity (ROE) vs. Cost of Equity (COE), Operating Profit Margin (Inverse of Efficiency Ratio) and Standard Deviation of the Operating Profit Margin over 3 to 5 years. Components of the operating profit margin are also analyzed separately and rated. As an example, margins with a negative spread between ROE and COE, an operating profit as a percent of net interest and noninterest income (OPM) below 20% and a standard deviation in the operating profit margin of 8 or higher, together, indicate a bank or savings institution at risk. Many combinations of ROE less than COE and the level and standard deviation of the operating profit margin determine varying levels of risk to the bank or savings institution.

Commercial banks and savings institutions with ROE less than COE, narrow or negative operating margins and/or large standard deviations in the operating profit margin are ranked by IDCFP below the rank industry standard for safety and soundness of “125” (300 the Highest and 1 the Lowest).

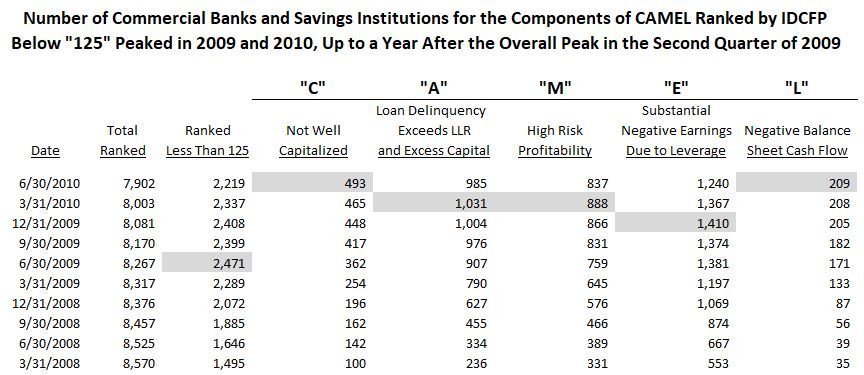

As seen in the table below, the number of commercial banks and savings institutions, ranked less than the industry standard of “125”, peaked in the 2nd quarter of 2009 at 2,471 or 30% of the 8,267 total number of domestic commercial banks and savings institutions. The number of commercial and savings institutions with limited profitability, as noted above, peaked at 1,024 three quarters later, March 31, 2010.

Other rating agencies that primarily focus on capital ratios and delinquency of loans fail to capture the risk in profitability and are missing key ingredients in the overall rating of a financial institution. As seen in the analysis of the components of CAMEL as calculated by IDCFP, categories of CAMEL with their risk calculations lag behind the unique and timely combination of these components in IDCFP’s summary rank of financial ratios.

This illustrates that all 5 categories of rank, C-Capital, A-Adequacy of Capital, M-Margins as a Measurement of Management, E-Earnings from Operations and, separately, Earnings from Financial Leverage, and finally, L-Liquidity all together provide a timely indication of risk and potential failure.

Most important, the number of banks and savings institutions with IDCFP ranks below “125” began sharply increasing after the 2nd quarter of 2006, well before the financial crisis of 2008 and 2009.

IDCFP has been helping CD brokers and investors, insurance companies, federal agencies, numerous state governments and a host of other institutions make better decisions using its unique and proprietary CAMEL rating methodology since 1985. For more information on CAMEL go to www.idcfp.com or call 1-800-525-5475.