Credit Unions: A New Growth Opportunity in Brokered CDs

Credit unions issuing brokered CDs averaged just 5 institutions per quarter from 2008 to 2015. Beginning in the 2nd quarter of 2015, these institutions accelerated from 5 to 147 by the 2nd quarter of 2019. IDC Financial Publishing (IDCFP) estimates by 2020, credit unions with brokered CDs outstanding could reach 300 or more. This new growth opportunity in brokered CDs makes monitoring credit unions increasingly important.

IDCFP uses the acronym CAMEL to represent the financial ratios used to evaluate the safety and soundness of commercial banks, savings institutions and credit unions. In the following article we measure these components of our CAMEL rank specific to credit unions.

IDCFP’s CAMEL ranks of banks, savings institutions, and credit unions range from 300 (the top grade attainable) to 1 (the lowest). From the early 1990’s, through today, institutions using our CAMEL criteria determined that those ranked lower than 125 were deemed below investment grade.

Monitoring At-Risk Credit Unions Issuing Brokered CDs

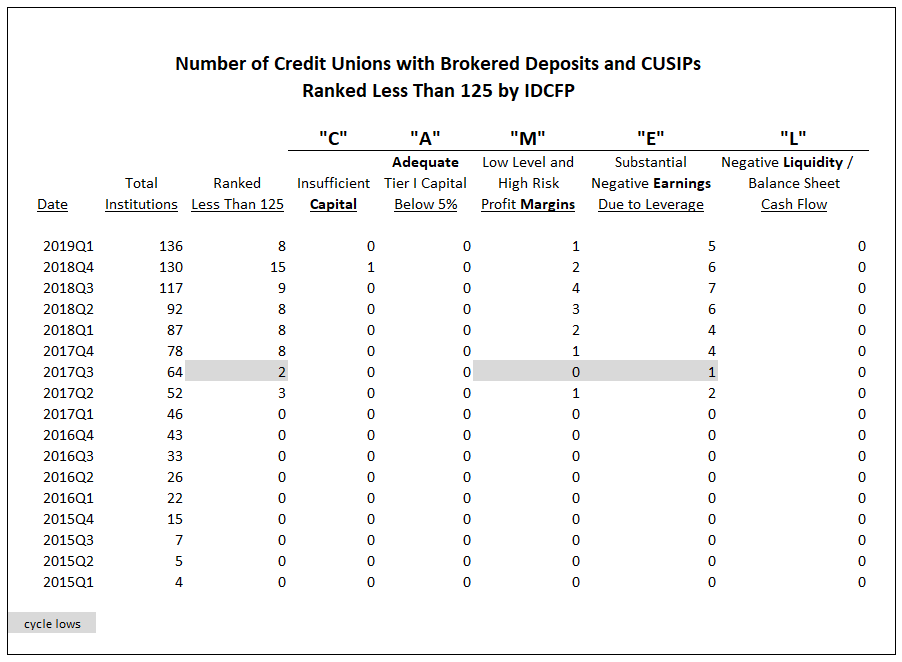

Out of the 5,445 total credit unions, IDCFP has identified 136 that have outstanding brokered CDs as of March 31st, 2019. Using this group of 136 and tracking those ranked less than 125 within this group identifies problematic credit unions. The sample of institutions shown in Table I is small but accelerating, with an estimated $5.4 billion in brokered CDs, and is therefore a key segment to monitor.

Table I shows how this group of credit unions reached a low of 2 in the third quarter of 2017, rose to 15 in the fourth quarter of 2018, then receded to 8 in the first quarter of 2019. These 8 institutions we identify as ranked under 125 have a generally weak profit structure. The numbers of institutions reflected under each CAMEL component, however, exhibit significant risk under that specific category.

- The “C” component, or credit unions with insufficient capital, fell from 1 back to 0 in the first quarter of 2019.

- The “A” component, which represents credit unions lacking adequacy of capital to cover delinquency with less than 5% risk-adjusted capital, remained at 0 in the first quarter of 2019.

- The “M” component, which uses margins as a measure of management, dropped from a high of 4 in the third quarter of 2018, to 1 in the first quarter of 2019, but remained above the low of 0 in the third quarter of 2017.

- The “E” component, which represents credit unions exhibiting negative earnings or returns on financial leverage (ROFL), dropped from 6 to 5 in the first quarter of 2019, but remained above the low of 1 in the third quarter of 2017.

- Finally, the “L” component, representing negative liquidity, or high levels of loan delinquency with negative balance sheet cash flow, remains at 0 in the first quarter of 2019.

Table I

A Forecast for the Next Problem Period in Credit Unions

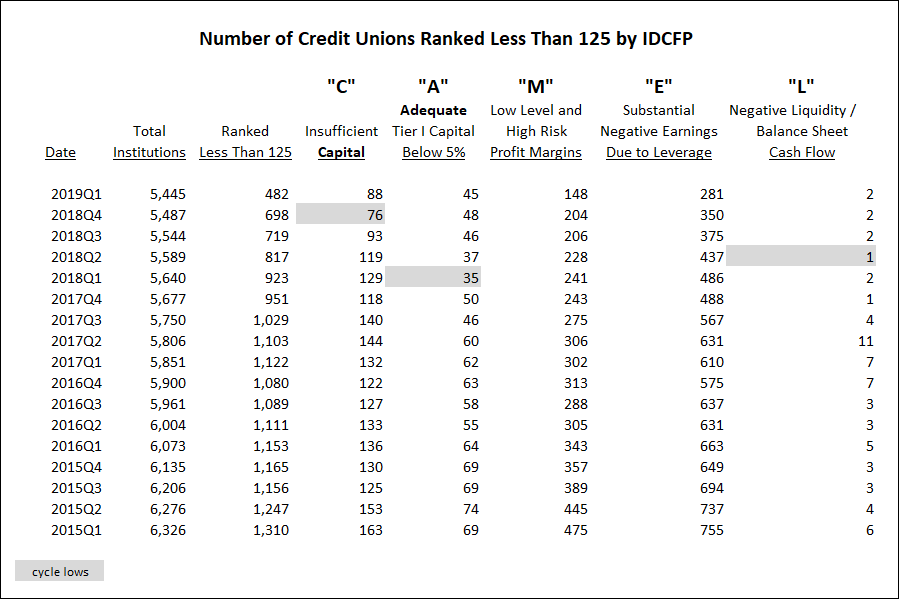

When examining all credit union ratings with our CAMEL rank, only one component (“A”) has shown signs of possible risk in the future. Most importantly, the number of credit unions ranked less than 125 continues to decline (see Table II), therefore, there is little risk of a future crisis for all credit unions.

- The “C” component, or credit unions with insufficient capital, rose from 76 to 88 in the first quarter of 2019.

- The “A” component, which represents credit unions lacking adequacy of capital to cover delinquency with less than 5% risk-adjusted capital, reached a low in the first quarter of 2018 and totaled 45 in the first quarter of 2019.

- The “M” component, which uses margins as a measure of management, continues to decline, reaching a new low of 148 in the first quarter of 2019.

- Similarly, the “E” component, which represents credit unions exhibiting negative earnings or returns on financial leverage (ROFL), is still declining, reaching a new low of 281 in the first quarter of 2019.

- Finally, the “L” component, representing negative liquidity, or high levels of loan delinquency with negative balance sheet cash flow, remains at 2 in the first quarter of 2019, up from its low of 1 in the first quarter of 2018.

Table II

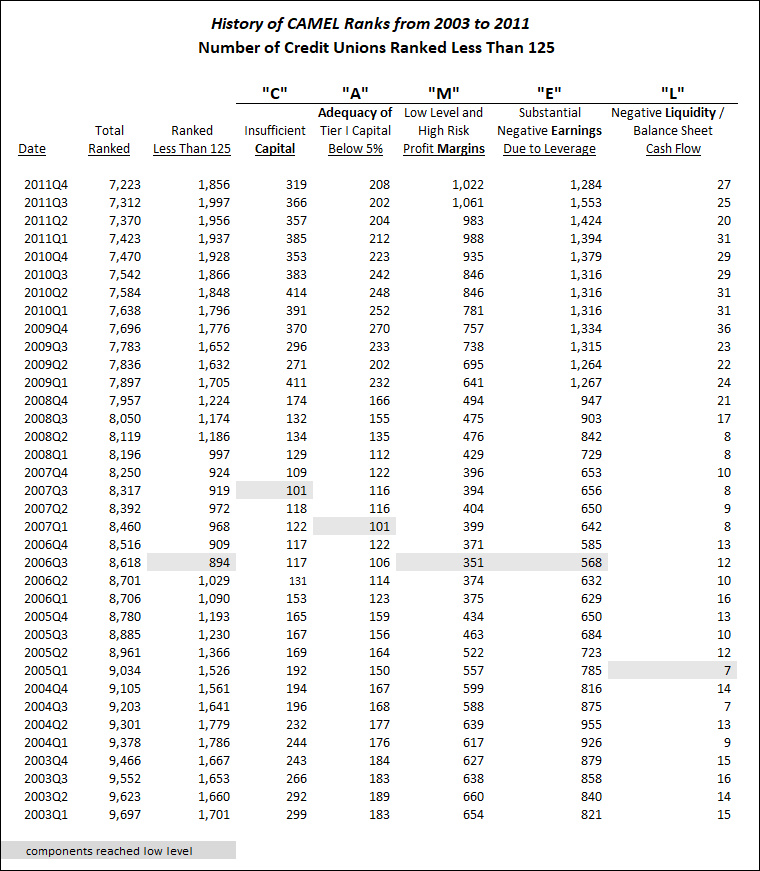

In order to forecast a crisis, all elements of CAMEL combined must display a trend where the number of institutions reach a low and subsequently increase. We saw this in history, from 2005 to 2007, when our CAMEL ratings under 125 of all credit unions forecast the crisis from 2008 to 2011 (See Table III).

Early Warning Indicators in History

Table III lists CAMEL ranks of credit unions from 2003 to 2011. In the 3rd quarter of 2006, a low of 894 institutions were ranked below 125 by IDCFP. Two elements of CAMEL also reached lows in the 3rd quarter of 2006, and steadily rose for two years before the financial crisis in 2008. More importantly, leading up to this point, 1 of the 5 components of CAMEL reached a low in the 1st quarter of 2005, and began to rise.

As seen in Table III below,

- Credit unions with insufficient capital reached a low of 101 in the 3rd quarter of 2007.

- Those with less than 5% risk-adjusted capital to cover loan delinquency, or lacking adequacy of capital, reached a low count of 101 in the 1st quarter of 2007.

- Credit unions with a lack of profitability, or low and unstable margins, reached a low count of 351 in the 3rd quarter of 2006.

- The credit unions with severe negative earnings due to financial leverage reached their low of 568 in the 3rd quarter of 2006.

- Finally, those with high loan delinquency and negative balance sheet cash flow, or negative liquidity, reached a low of 7 in the 1st quarter of 2005.

The credit union crisis, which was forecast by IDCFP’s CAMEL rankings in the third quarter of 2006, continued to accelerate for years. This resulted in more credit unions rated less than 125, reaching its peak of 1,997 institutions in the third quarter of 2011 (see Table III).

Table III

In addition to the total number of credit unions ranked less than 125, all 5 categories of rating provided a timely indication of risk and potential failure. All these elements combined displayed a trend where the number of institutions reached a low and subsequently increased, forecasting the credit union crisis of 2008.

As seen in history, the increase in the number of credit unions with our CAMEL rating below 125, or below investment grade, forecast the financial crisis a few years later. Our ratings are critical for investors to monitor credit unions, as well as other financial institutions, and prepare for potential risk.

To view our products and services please visit our website at www.idcfp.com . For more information about our CAMEL ratings, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director