High Leverage that Yields Negative Earnings Creates Risk

At IDC Financial Publishing (IDCFP), the acronym CAMEL represents the financial ratios we use to evaluate the safety and soundness of commercial banks, savings institutions and credit unions. The "E" component of our CAMEL Rating represents institutions with substantial negative earnings due to leverage.

Banks with a low return from operations, combined with rising funding costs, creates a negative leverage spread. This negative spread, multiplied by a bank’s leverage, provides a highly negative ROFL, and, as a result, leads to a rank below 125. From the early 1990’s, through today, institutions using our safety ranks determined that ratings lower than 125 were deemed below investment grade. Our CAMEL ratings range from 300 (the top grade attainable) to 1 (the lowest).

IDCFP looks at an institution’s Return on Equity (ROE) in terms of two components: return on operating earning assets (ROEA) and return on financial leverage (ROFL).

- ROEA measures the profitability of an institution’s operating strategy. It is the percentage of after-tax income from operations before funding costs divided by earning assets. Components of this numerator include income from loans and investments, non-interest income, less operating expenses and taxes, plus the change in the loan loss reserve. ROEA reflects the operation of an institution, as if equity and the loan loss reserve were total liabilities and capital.

- ROFL measures the profitability of an institution’s financial strategy and reflects the degree to which an institution uses deposits and debt to finance its operating strategy. IDCFP defines ROFL as the leverage spread (after-tax operating income [ROEA] less the after-tax cost of net-adjusted debt) times the leverage multiplier. The leverage multiplier equals net adjusted debt (earning assets less equity capital and the loan loss reserve, or those earning assets funded by deposits and debt) divided by the total equity capital plus the loan loss reserve.

A Specific Category of Banks Creates a Superior Forecast

We focus on commercial and savings banks with brokered deposits as the best group of banks to analyze risk. Historically, institutions with brokered deposits* held most of all domestic liabilities and equity capital. This was the case in the years prior to the 2008-2009 banking crisis and remains the case today. This universe of banks is the best for statistical analysis and measure of potential financial crisis because of these characteristics:

- Control most of all domestic liabilities and capital, equal today to 91% of all bank holdings.

- High loan and deposit growth.

- Require brokered deposits over and above their core deposits to meet loan demand.

The remaining 3,294 banks are also ranked by IDCFP for safety and soundness; however, these smaller institutions present limited risk as a group to banking industry solvency.

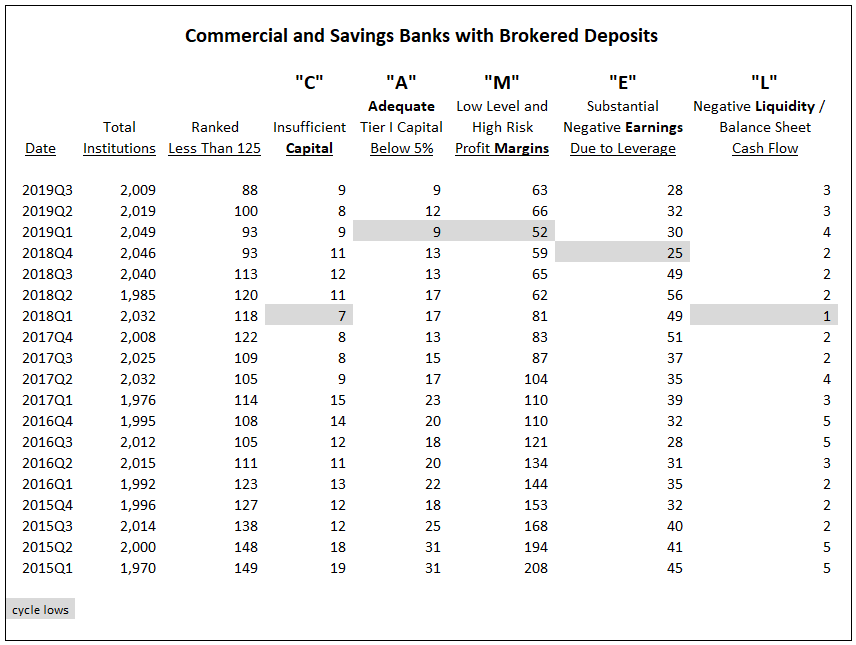

Out of the 2009 institutions with brokered deposits, IDCFP identified 88 ranked below investment grade in the third quarter of 2019 (see Table I). This number decreased from 100 the previous quarter. When the number of these poorly rated banks reaches a low and begins to rise, both in the total number of institutions ranked and by CAMEL component, there is potential for a future crisis.

*Brokered deposits exclude reciprocal deposits in this analysis due to changes in reporting requirements on reciprocals that distort history

The Effect of the Inverted Yield Curve in 2019

Many forecasters expected a recession in 2019 or 2020 and, therefore, a potential banking crisis. Their belief was primarily due to the inverted yield curve, which occurred in the first 10 months of 2019, when the 90-day T-Bill yield was greater than the 10-year T-Note yield. A positive yield curve has since been reestablished due to three reductions in the federal funds rate by the Federal Reserve, but the period of an inverted yield curve in U.S. Treasuries, therefore, produced false warning signals.

Forecasting the Next Banking Crisis

IDCFP’s rank analysis in total and by component of CAMEL through 2019Q2 forecast the potential for a future banking problem. However, the bank financial data for the third quarter of 2019 neutralized this alert, as we have seen renewed decline in the number of poorly ranked banks (See Table I). The subsequent positive yield curve and continued decline of total banks ranked below 125 negated the warning signs of a banking crisis and has restarted our forecast process.

Under our CAMEL analysis, only the number of banks ranked below 125 with Insufficient Capital have risen, while the numbers under other components are again in decline or remain unchanged (see Table I). An increase in the total number of commercial and savings banks ranked under 125 in a future quarter would indicate a future banking problem. Banks ranked below investment grade by each component of CAMEL would also be required to advance in number.

Table I

In History: The Warning Signs Before a Financial Crisis

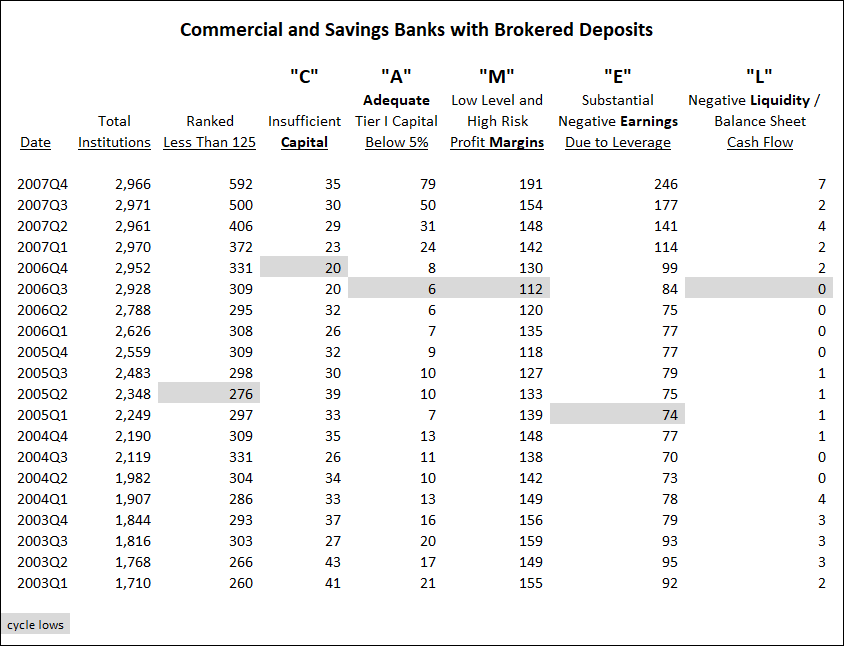

At-risk banks with brokered deposits began to rise in 2005. The number of banks with brokered deposits ranked less than 125 by IDCFP, or below investment grade, reached its low of 276 in the second quarter of 2005, then rose above that level, accelerating in late 2006 and through 2007. This rise in banks ranked below investment grade by IDCFP signaled the financial crisis with a 3-year lead time (see Table II).

Rise in at-risk banks with brokered deposits under each component of the CAMEL rank also began in 2005. Table II shows how each component of IDCFP’s CAMEL ranks reached cycle lows in the number of institutions ranked under 125 and subsequently rose to higher numbers well in advance of the financial crisis (see Table II).

- The earliest warning came from the E in CAMEL falling to 74 in the first quarter of 2005.

- In the third quarter of 2006, the A, M and L also reached lows.

- In the fourth quarter of 2006, the C in CAMEL reached its low 18 months before the financial crisis.

After reaching lows in number of at-risk banks, note that both the number of total banks and number by components of CAMEL subsequently accelerated through 2007.

Table II

As seen in history, the increase in the number of financial institutions with an IDCFP CAMEL rating below 125, or below investment grade, forecast the bank financial crisis, with the necessary lead time to take action. Our ranks are critical for investors to monitor financial institutions and prepare for potential risk.

To view our products and services please visit our website at www.idcfp.com . For further information about our CAMEL ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director