Disruption of the Repo Market and Intervention by the Fed Could Create the Next Expansion of the Fed’s Balance Sheet

The Federal Reserve’s holdings of bonds, loans, and other assets accelerated from $4.2 billion in February to $7 trillion in June, as result of multiple financial assistance programs and support of the repurchase market. The Fed’s asset-buying, however, has come to an abrupt halt after surging in the spring of 2020.

Since June, the Fed’s balance sheet total has remained unchanged and the pause in the portfolio’s growth relates to three factors. The first is “classic lender of last resort” or flooding the short-term funding market with loans. In July, the central bank had no takers for short-term overnight loans called repurchase agreements, down from more than $440 billion in March. Arrangements where the Fed lends dollars abroad via currency “swaps” with foreign central banks declined to $122 billion in late July from $449 billion in May.

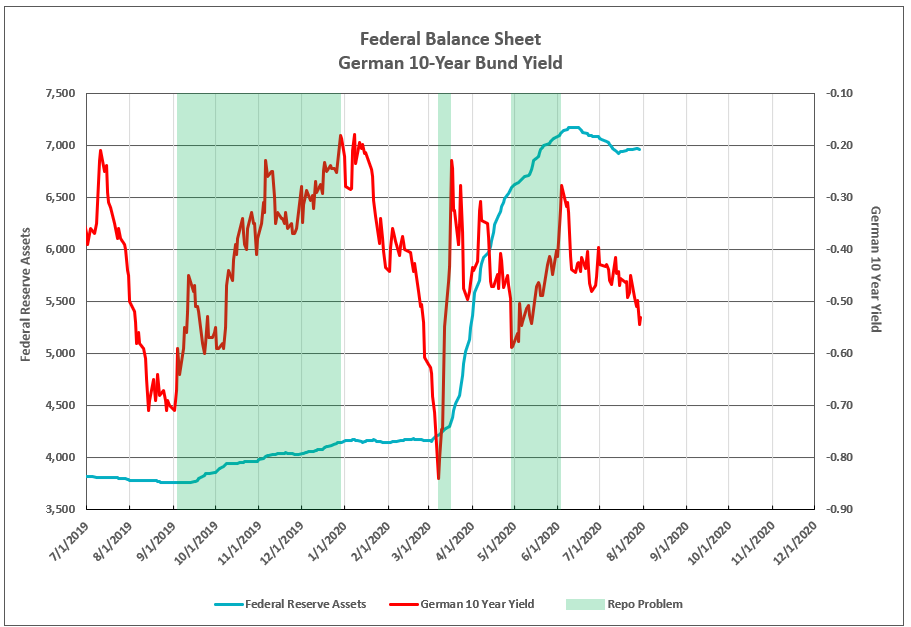

The required support of the repo market by the Fed directly correlates to a sudden improvement in German yields, which occurred beginning in September 2019, in March, and again in May 2020 (see Chart I). The sudden rise in the German 10-year yield disrupts the repo market. A sharp increase in the German 10-year yield from near-record negative yields of -0.54% or more negative in August 2020, to less negative levels of -0.30% to -0.20%, would trigger another repo market disruption, Fed intervention and new increases in the Fed’s balance sheet. Given this event, short-term US Treasury yields would decline toward zero, while long-term treasuries would rise, steepening the yield curve.

Chart I

The second factor in balance sheet expansion is the Fed as a “market maker of last resort” and the purchase of Treasury and mortgage-backed securities, when fire sales of the normally super-safe assets overwhelmed Wall Street dealers. The Fed has bought $2.5 trillion of these assets, accounting for almost all the portfolio expansion in late March and April (see Chart I). The pace slowed, however, as recovery in the economy and market forces returned to more normal valuations.

The third factor is the central bank backstopping an array of credit markets, as these lending actions fell far short of expectations. These programs would allow for nearly $3 trillion in borrowings. The Fed has so far extended $104 billion. The lending programs are complicated and difficult to use. The simple announcement of the program allowed the market to rally before the Fed spent a dollar, accomplishing the Fed’s goal. Support of the corporate and municipal bond markets, therefore, required no Fed action for the third factor to expand the Fed’s balance sheet.

For further information or to view our products and services please visit our website www.idcfp.com or contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director