The Impact of the German 10-Year Yield on Bank and Epicenter Stocks

A Review of History

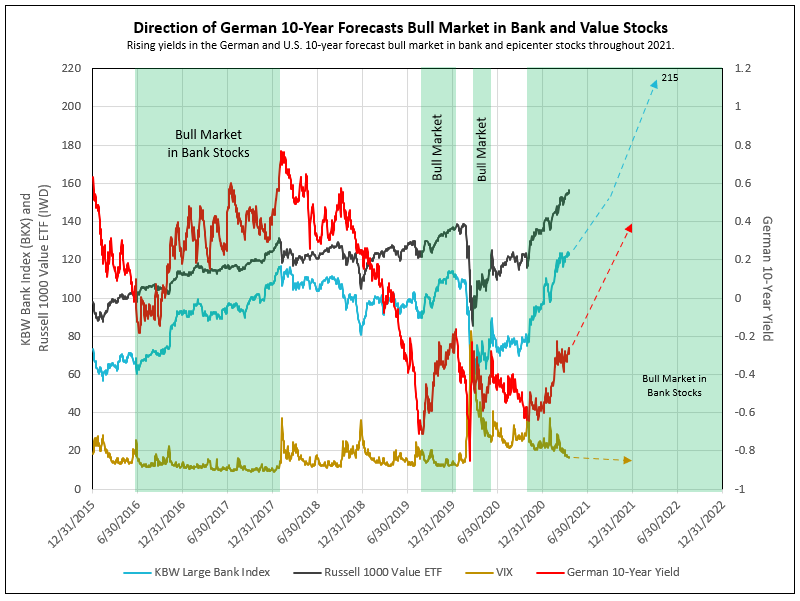

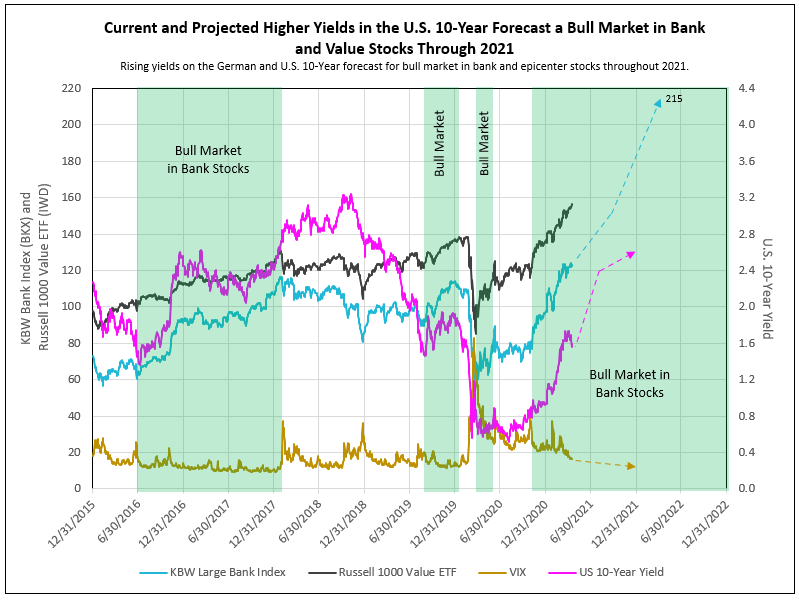

As illustrated in Chart I, the low in the German 10-year in June 2016 coincided with the low in bank stocks and a peak in the volatility (VIX), creating the bull market in bank and epicenter stocks that lasted until the peak in the German 10-year in February 2018. The U.S. 10-year failed to provide a clear picture of this bull market, with its decline in 2017 compared to the continuous rise in the German 10-year (see Chart II).

A breakout in the German 10-year yield above -0.21% projects from the inverse head and shoulder formation a positive 0.40% yield and, therefore, a US 10-year yield at 2.4%, given a 200-basis point spread.

Chart I

Chart II

The sudden and significant peak in the German 10-year yield in early 2018 forecast the peak in the stock market and the end of the bull market in bank and epicenter stocks.

Why?

The Trump tariffs shut down Chinese auto demand, which accounts for 50% of German GDP, forcing the Bundesbank to stimulate the German economy by reducing interest rates. The change in Bundesbank policy caused a continuous decline in the German 10-year from February 2018 to August 2019, which favored growth stocks. During this period, banks and epicenter stocks under-performed. As the German yield declined, the pressure built up until late August 2019, when the Bundesbank reversed policy once more, resulting in a rapid rise in the German 10-year yield. On September 3rd and 4th, 2019, there began a huge rally in bank and epicenter stocks, which continued through year end 2019. The low in yield in August 2019 displayed the beginning of an inverse head and shoulder pattern, and the “left shoulder” (see Chart I).

Covid arrived in early 2020, with the huge sell off creating the market low on March 23, 2020, following the low in 10-year yields and the peak in the VIX. The extreme low in German Yields in March 2020 created the “head” in the inverse head and shoulder pattern (see Chart I).

Banks and epicenter stocks provided a strong short-term recovery until the German 10-year peaked on June 6, 2020. Not until the German 10-year yield reached its low in October 2020 did the current bull market in bank and epicenter stocks begin. The final low in German yields in October 2020 created the “right shoulder” (see Chart I).

Currently, U.S. 10-year yields have temporarily stalled, as the German 10-year consolidates between -0.22 % and -0.33%, awaiting a clear picture of a decline in Covid in Germany and Europe. One day in the not-too-distant future, the German 10-year will break out of the inverse head and shoulder formation (the “neckline”) to -0.20% or higher yield. The stock market, led by banks and epicenter stocks, will again perform like it did on September 4, 2019, with a huge rally. But growth stocks will stall, as the rotation again moves funds into the value, bank, and epicenter stocks.

The rise in the German 10-year yield to +0.40% (as predicted by the breakout in the inverse head and shoulder pattern) and the U.S. 10-year to 2.4% (forecast by the copper-to-gold ratio) by the summer 2021 forecasts bank operating returns [after operating costs and taxes, but before funding costs] to rise to the 2019 Q4 levels, resulting in another 70% appreciation potential in bank stocks.

Update on Covid-19 and the Economy in Germany

Beginning in October 2020, Germany saw a surge in its Covid cases, peaking in late December, then surged again in mid-January, followed by a third wave in early April. Deaths peaked in mid-January and have slowly been declining but saw a slight uptick earlier this month. After a slow start, Germany is now doubling its efforts to administer vaccines. “The country administered about 720,000 doses on Thursday, a fourth straight daily record, thanks to a surge in vaccinations in doctors’ offices. That pace should continue for most of April as a network of some 35,000 general practitioners receive 1 million doses more in each of the next two weeks -- and even more after that.”1 This all indicates that herd immunity is only weeks away in Germany.

The cause of the 2018 peak in the German 10-year, the dramatic decline in China auto sales, reversed in 2021. Chinese passenger vehicle sales climbed 69%, increasing year-over-year to 5.09 million units in the January-to-March period, putting sales just below the March 2018 record quarter, when 5.67 million cars were sold.2

China, a critical market for German and other global auto makers because of its unrivaled scale, is on a path to regain the heights of the previous decade’s boom. Combining the recovery in China with the expected durables boom in the U.S., German exports and GDP are set for a return to prosperity, record expansion and, therefore, higher German 10-year yields.

The Stock Market Outlook

A sharp rise in German yields above -0.20% in the near future, as Germany resolves its Covid crisis, would spark the significant rally in bank and in epicenter stocks, similar to what occurred from September 4th to December in 2019. Famed Professor Jeremy Siegel of The Wharton School said on the CNBC halftime report on April 8th, “the economic and stock market recovery with growth in tangible assets, earnings and equity,” (offered by banks and epicenter stocks), “…are only in the third inning.”

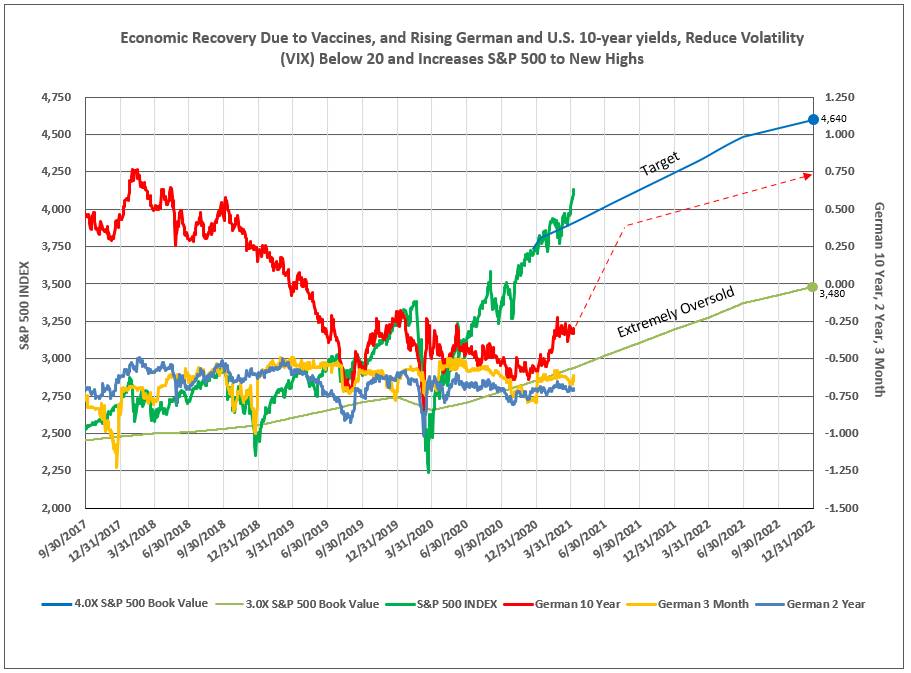

As illustrated in Chart III, all major bear markets to major oversold levels in the S&P 500 were directly related to a decline in German 10-year yields, as occurred in the 4th quarter of 2018, April to August 2019 and early 2020. Rising German yields were associated with bull markets in late 2017 to early 2018, the 3rd quarter 2018, September to December 2019, and March 2020 to date. A rise in the German 10 year to 0.40% in the coming months will certainly create much higher stock prices, which will be led by banks and epicenter stocks.

Chart III

1 - Germany Doubles Pace of Covid-19 Shots Amid Surge in Cases

2 - China Car Sales Soar to Pre-Pandemic Levels

To view all our products and services please visit our website www.idcfp.com.

For more information about our Deposit Database, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director