In Periods of Economic Recovery, the U.S. 10-Year TIPs Yield Equals or Trends Toward the German 10-Year Yield

Chart I

The Relationship Between U.S. and German Yields

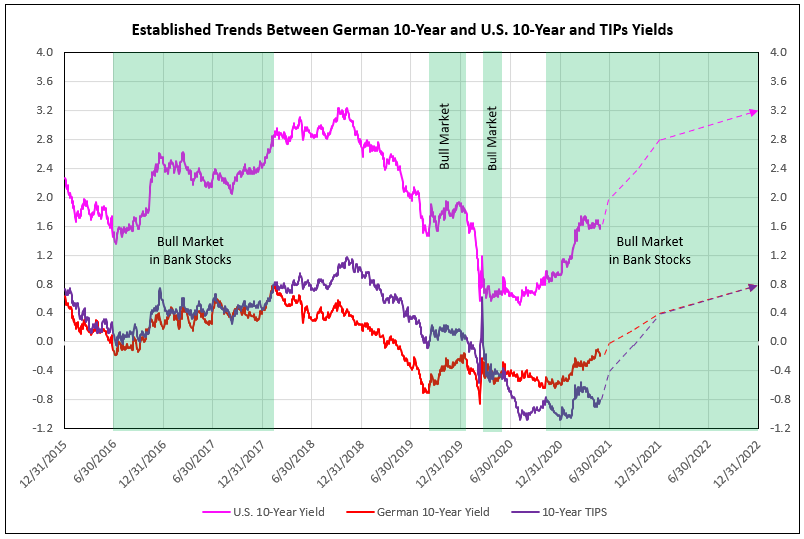

From June 2016 to February 2018, the US 10-year tips yield was nearly equal to the German 10-year yield during a prolonged economic recovery and bank bull market. Rising German, U.S. nominal and TIPs yields favored the bank stocks (see Chart I).

Beginning in February 2018, the Federal Reserve began to aggressively raise the Fed Funds rate, while Trump tariffs on Chinese goods reduced German exports. Despite rising US yields on the 10-year, German yields declined significantly, as the Bundesbank attempted to protect German industry from the effects of tariffs.

The prolonged decline in German 10-year yields finally reached a low in August 2019, which began the next bull market in bank stocks. The German 10-year closed the gap with the U.S. TIPs yield into early 2020 (see Chart I).

Chart II

Impacts from Covid-19 and Resulting Fed Action

Then Covid appeared in February 2020, shutting down the economy, and resulted in Fed monetary stimulation. Initially, the tips yield fell to equal the German 10-year from March to early May 2020, providing the next bull market in bank stocks. The TIPs yield, however, continued to decline below the German 10-year, causing bank stocks to stall (see Chart II).

Finally, the German 10 year reached it low in October 2020, completing the right shoulder of the inverse head and shoulder pattern, beginning the current bull market in bank stocks. In May 2021, the German 10-year yields continued its recovery, breaking out of the neckline of the reverse head and shoulder formation. Initially, in the first quarter of 2021, the U.S. TIPs yield rose and narrowed the spread to the German 10-year. However, weak U.S. economic data and an aggressive Fed allowed the spread to widen from March to May.

Continued Recovery Drives Higher Yields

In economics, there remains a natural affinity to have the U.S. 10-year tips yield equal the German 10-year yield. With implied inflation of 2.4%, the nominal 10 year could increase to as much as 2.8% by year-end 2021 and 3.2% by the end of 2022. See IDCFP’s article from May 3rd with further evidence to support this projection. This forecast interest rate environment is difficult for growth stocks, but highly favorable for reopening epicenter, value and, especially, bank stocks.

Continued strength in the U.S. and world economies in the second and third quarters of 2021 drives a higher TIPs yield, rising toward the German 10-year in the last half of 2021 and into 2022. As seen in Chart II, the resulting continuous rise in the nominal U.S. 10-year yield in 2021 and 2022 creates the bull market in bank stocks for the next 20 months or more. IDC Financial Publishing’s bank stock model forecasts a 57% appreciation potential in the BKX bank stock index (large money-center, regional and credit card banks).

For further information or a copy of this article, and to view all our products and services please visit our website at www.idcfp.com or contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director