TIPS Yields Forecast Inflation Measured by Dallas Fed’s Trimmed Mean Core PCE at or Near a Peak

The cycle low in Treasury Inflation Protected 5- and 10-Year Yields (TIPS) is due to several reasons.

- The Russian invasion of Ukraine caused volatility in the markets, particularly with 5- and 10-year TIPS yields approaching cycle lows in early March 2022. These yields previously reached lows in mid-November 2021, which, at that time, priced COVID fears.

- The Fed is expected to taper purchases of U.S. Treasury securities and raise the Fed funds rate to 1% in four quarter point increases in 2022.

- The expectation for the Fed to reduce the size of its balance sheet later in 2022.

- The temporary lifting of the debt ceiling, allowing issuance of Treasury debt.

The yield on the 10-year is expected to increase to 2.15% by mid-year and 2.4% by year-end 2022.

What About Inflation?

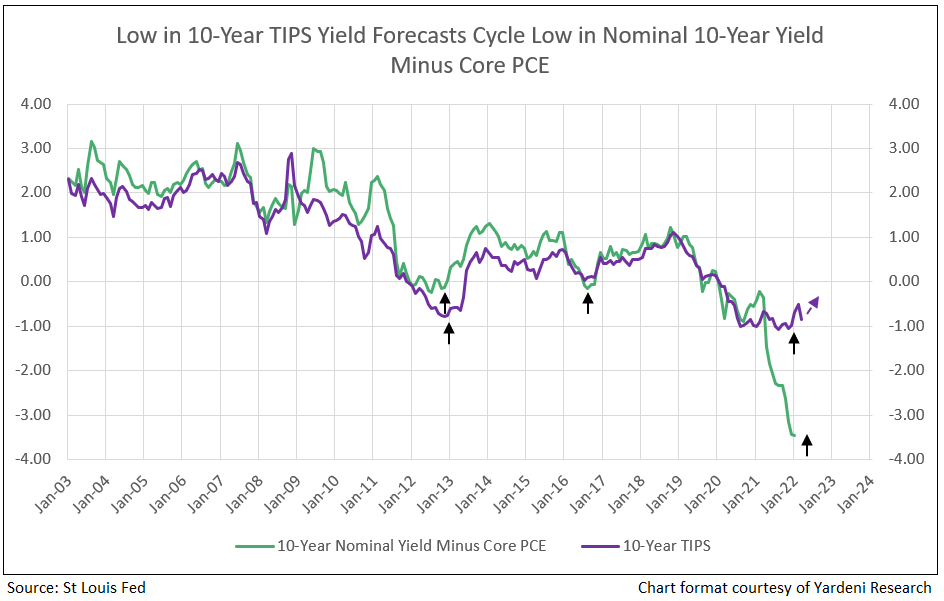

The 10-Year yield minus the core PCE inflation rate is expected to reach its most negative point and reverse, as forecast by the U.S. Treasury market with a low and recovery in the TIPS yield (see Chart I).

The corporate bond market confirms the forecast from U.S. Treasury TIPS yields with the ratio of the investment grade bond ETF (LQD) to the high yield bond ETF (HYG) declining to new cycle lows, indicating buying of epicenter stocks and a peak in inflation (see our article about structural change in the bond market from February 28, 2022 and Chart I).

Bloomberg Economists stated on March 4, 2022, based on analysis of the February job report, “The easing of labor shortages appears to be starting to slow the pressure on wages, which could provide a glimmer of support to the optimists in the FOMC that inflation might come down later this year.”1

However, increases in oil prices impact inflation because they affect vital components of the economy like transportation, manufacturing, power generation, chemicals, and materials. The measured effect, according to J.P. Morgan’s chief economist Bruce Kasman, is that a 10% increase in the price of oil removes 0.2% from global growth and adds 0.3% to the CPI.

Of further note, from Fundstrat’s Tom Lee on March 7, 2022, “Oil surged to $130, but is 3% of the consumer wallet, still below 4.5% in 2008 and 6.5% in 1980. At $200 it would equal 4%.”

Forecasts from the Lows in 10-Year TIPS

The cycle lows in the 10-year TIPS yields in 2013, 2016 and late 2021 forecast the cycle lows in the U.S. nominal 10-year yield minus the core PCE inflation rate (see Chart I).

Chart I

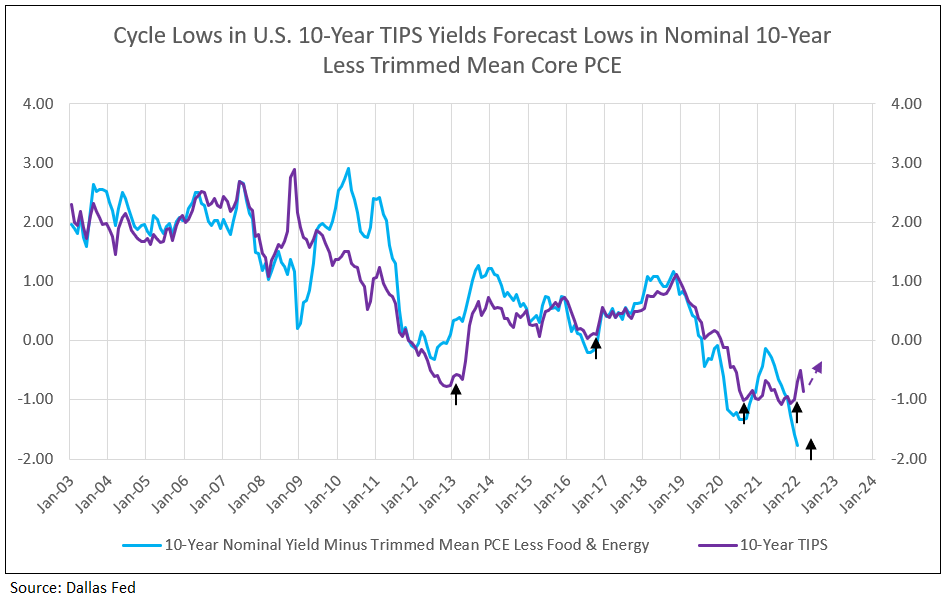

The cycle lows in the 10-year TIPS yields in 2013, 2016, 2020 and late 2021 forecast the cycle lows in the U.S. nominal 10-year yield minus the trimmed mean core PCE from the Dallas Fed (see Chart II).

Chart II

Implied Inflation Forecasts Inflation Peak

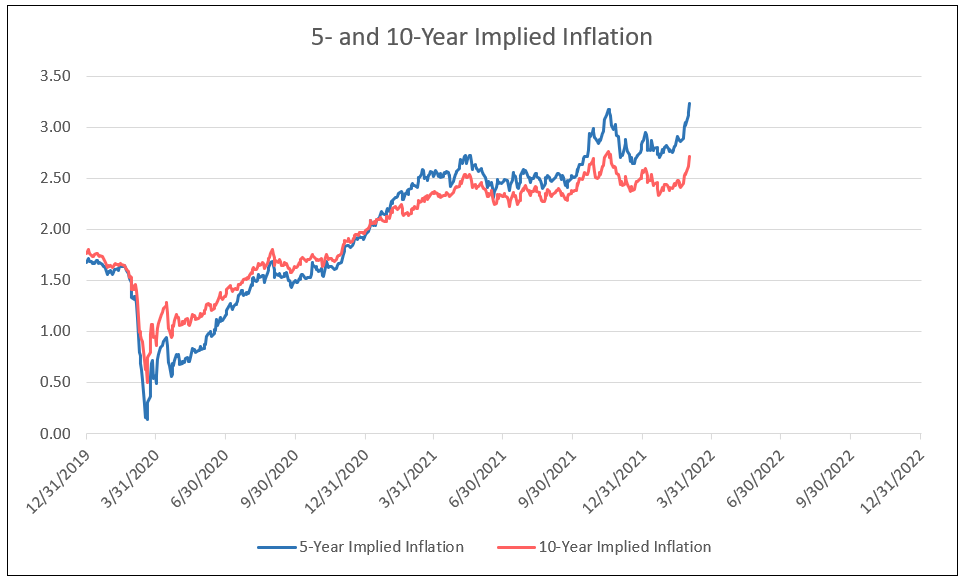

Implied inflation of the 5-year nominal T-Note less the TIPS yields is currently reaching new highs reflecting recent inflation reports and the Russian invasion of Ukraine. Implied inflation over the 10-year period is approaching, but not exceeding, the November peak (see Charts III and IV).

Chart III

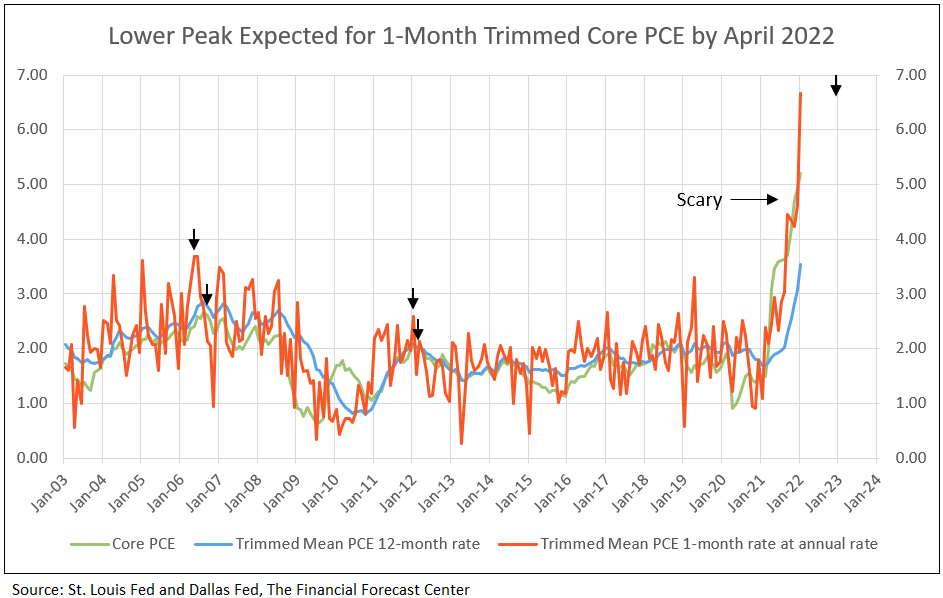

Chart IV

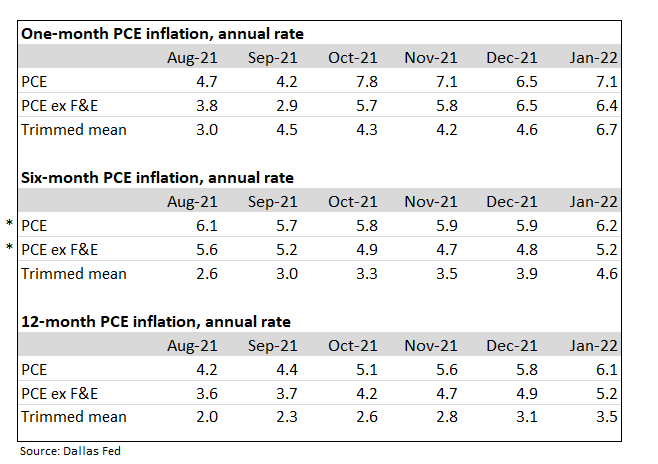

The Trimmed Mean PCE inflation rate is an alternative measure of sticky inflation in the price index for personal consumption expenditures less food and energy (Core PCE). It is calculated by staff at the Dallas Fed, using data from the Bureau of Economic Analysis (BEA).2

Note the six-month* PCE and Core PCE inflation in January 2022 was equal to or less than August 2021. Inflation, therefore, moderates significantly in the second half of 2022.

Table I

Trimmed Mean PCE Inflation Rates

Bull Markets in Bank Stocks

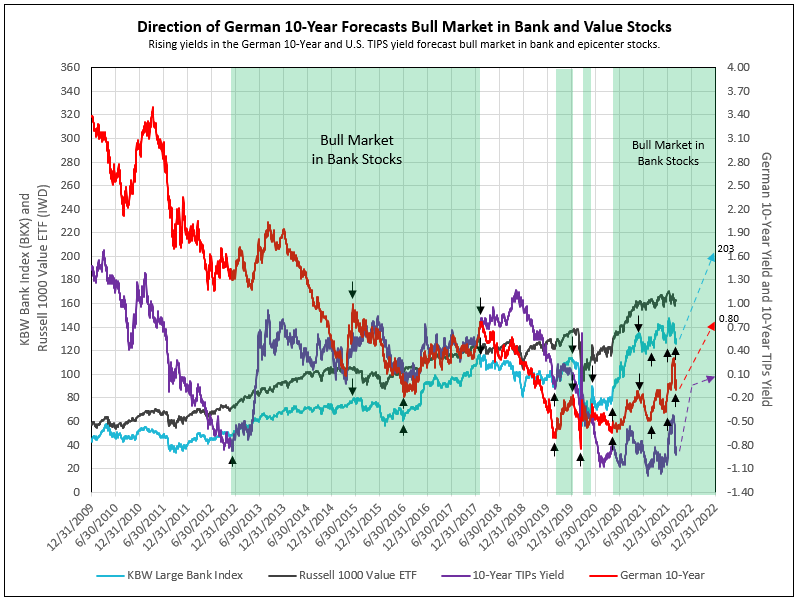

- The low in the 10-year TIPS yield at year-end 2012 began the 2012 to early 2018 bank stock bull market.

- Since 2015, the bull markets in bank stocks responded to the cycle low in the German 10-year confirming a low in the U.S. 10-year yield (see Chart V).

- The first leg of the current bull market in bank stocks began in October 2020 and paused for an intermission in mid-May 2021, due to the German 10-year yield reaching its peak of -0.11%.

- An intermission occurred between legs from May to August 2021, as the German 10-year yield declined to its cycle low.

- The next upward leg of the bank bull market began in August 2021.

- The recent volatility in the German 10-year yield is all due to the impact of Russia’s invasion of Ukraine. The yield went from a positive 0.31, declined to a negative 0.07, then recovered to +0.02%, before a decline on Friday, March 4 to -0.10, This irregularity was reflected in the U.S. 10-year TIPS yield and the price of bank stocks, as represented by the KWB NASDAQ Bank Index (BKX). This short-term fluctuation, however, fails to change the forecast for a continuation of the bank bull market throughout 2022.

Chart V

1 - U.S. Job Gains Accelerate While Wage Growth Slows Sharply, Bloomberg

2 - The Federal Reserve Bank of Dallas

To view all our products and services please visit our website www.idcfp.com. For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director