The Coming Peak and Decline in Inflation

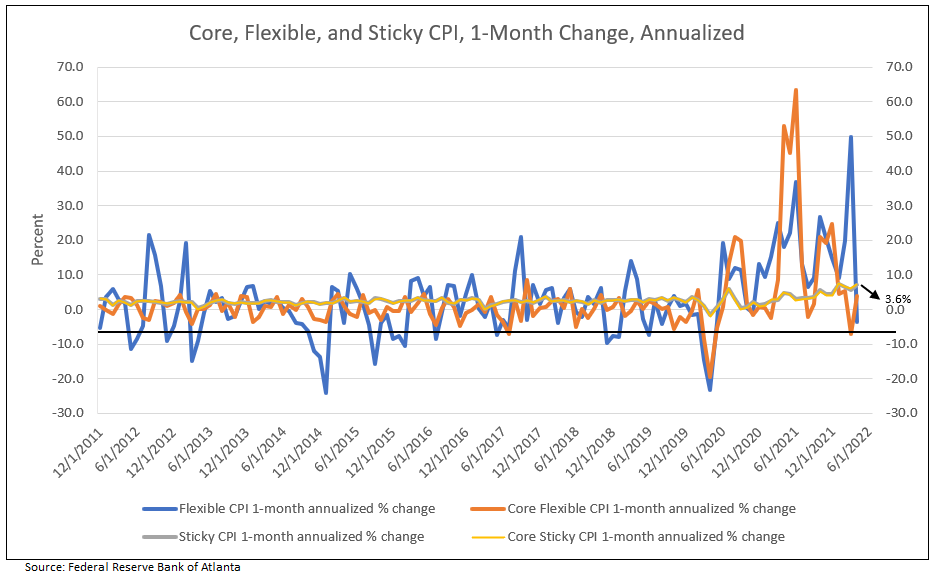

RenMac’s economists, using the April CPI and PPI data, estimated “core PCE” (the Fed’s preferred measure of inflation) will be reported at 0.30%, or 3.6% annualized, for April.1

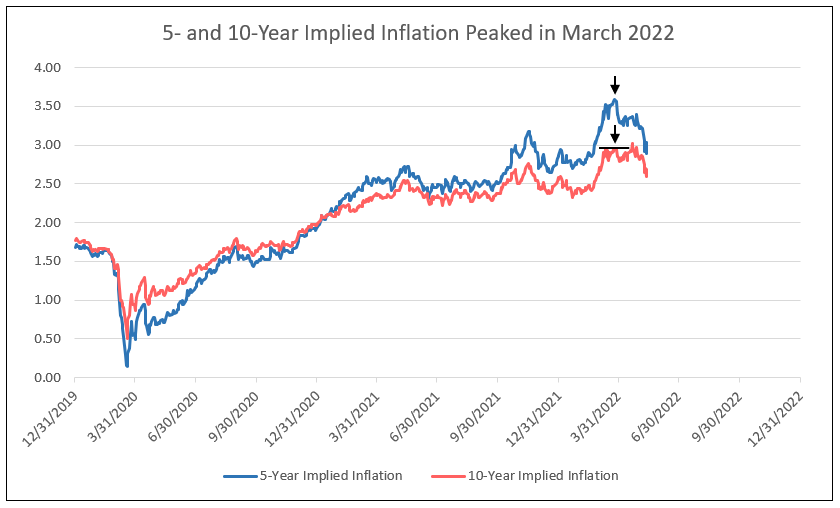

Chart I

Bond Market 5-Year Implied Inflation at 2.9% Forecasts a Future Core CPI and PCE Below 3%

Reasons for Inflation to Peak in Mid-Year 2022

1. Wages are rising due to the shortage of labor as participation rates remain subpar, but in the future post-pandemic economy, eligible workers return to the workforce, including early retirees as inflation drains savings. Also, as sited in the NFIB small business report, wage increases, which have been the highest among the lowest tier of economic earners, are slowing. Overall, the 3-month rate of change in wage growth (average hourly earnings) slowed to 3.8% in April, down from 6-month change of 4.7% and 12-month change of 5.3%.

2. CPI commodities excluding food and energy declined month-to-month from 1.0% in January to 0.2% in April.

3. The April Manheim Used Vehicle Value Index of used car sales and prices indicated prices peaked in December and have been down four consecutive months (a key component to flexible CPI). Used car prices account for 1.4% of CPI, while new cars equal 0.4%. Prior to 2020, used car prices accounted for zero percent contribution. Without cars, CPI would have been 2% lower, so instead of 5-6%, it is really 3-4% in 2021. Using a two-month lead time of the Manheim index change to “used car CPI” forecasts the “used car component at -1.0% by June from 0.4% in April.2

4. Backlog of ships is down to pre-September 2021 levels according to LA/LB reports.2

5. Cass Freight Index, which measures the aggregate goods moved by truck, has declined to a flat level year-over-year. Given the Cass Freight YOY leads CPI YOY by 6 months, CPI 12-month change readings decelerate through year-end.

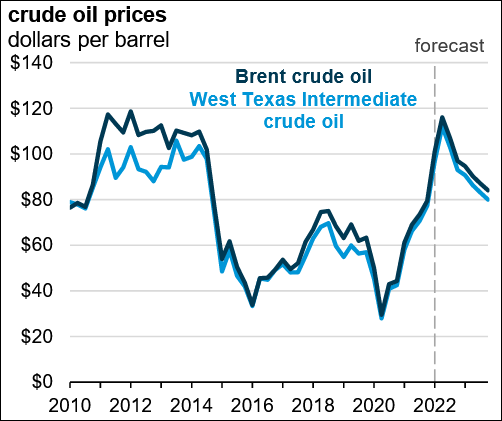

6. EIA expects crude oil prices to be higher than $100 a barrel in the coming months, and then a decline later in 2022 into 2023.3

On February 24, 2022, Russia initiated a further invasion of Ukraine that contributed to the recent sharp increase in the Brent and West Texas Intermediate (WTI) crude oil prices. This sharp rise in crude oil prices reflects increased geopolitical risk and uncertainty regarding how announced and potential future sanctions may affect global energy markets.3 In our April 2022 article, Inflation Peaks by Mid-Year 2022, we forecast the price of international benchmark Brent crude oil at $100 to $120 per barrel for the second quarter of 2022.

We forecast that the price for WTI, the U.S. benchmark, will average over $110 in May 2022. This forecast is subject to heightened levels of uncertainty due to various factors, including how Russia’s invasion progresses in Ukraine, government-issued limitations on energy imports from Russia, Russian petroleum production, and global crude oil demand.3

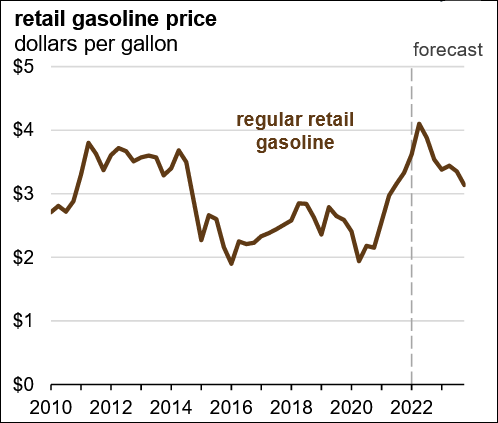

The forecast of Brent crude oil price increased the forecast for the retail price of gasoline. Expect gasoline in the United States to continue rising to a forecast high of $4.50 per gallon in May before falling through the rest of the year. We forecast the U.S. regular retail gasoline price will average $3.50 to $3.79 a gallon in the second half of 2022 and $3.00 to $3.33 a gallon in 2023 (see Charts II and III).

Chart II

Chart III

Charts II & III Source: U.S. Energy Information Administration, Short-Term Energy Outlook, March 2022

Ed Morse, a contrarian, and Citi’s Global Head of Commodity Research predicted on March 9 that December 2022 oil contracts would sell at $89 by year-end. “Today everyone seems bullish in the oil market, just like 2008 when Brent crude prices hit a record high of $150 a barrel, only to crash a few months later.“4 Morse agrees today’s oil market is tight and Russia-Ukraine war has escalated prices, but he anticipates a change in the second half of 2022. In his analysis, the market will shift from tight to surplus beginning in the spring of 2022. The shift is due to rising production from OPEC+, the Permian Basin and other U.S. shale basins, plus increased production in Canada and Brazil.

Morse has further indicated the SPR release and stated buy backs of crude will increase drilling rates by 1.3 to 1.5 million barrels of oil per day in the second half of 2022, over and above the 1 million barrels per day from the SPR release. Additionally, he states diesel prices were raised by equivalent natural gas price spikes increasing to new highs, but declining natural gas prices by the summer will cause a peak in diesel prices.5

7. The NY Fed reports inflation expectations reached a new high for the short-term, increasing to 6.6%, but eased for the medium-term to 3.7%. Median year-ahead household spending growth expectations jumped by 1.3% to 7.7%, marking a new high and largest month-to-month increase for the series – casting further doubt on the possibility of a recession.

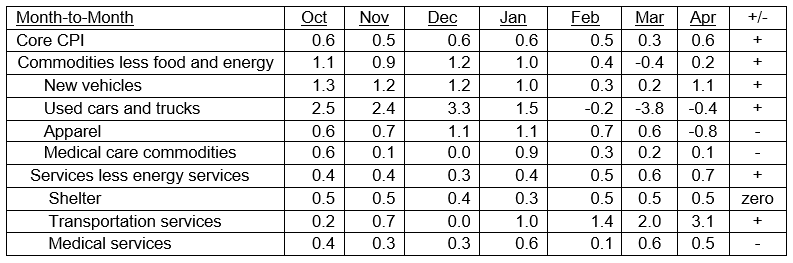

8. The greatest percent changes occurred in October, November, December, and January, but slowed in February and March. In April 2022, due to rising new vehicle prices and higher airfares boosted by fuel costs (transportation services), core CPI increased again to 0.6% (see Table I). In the second half of 2022, we expect core CPI to recede to 0.3%.

Table I

Percent Change in Core CPI for All Urban Consumers

Chart IV

One-Month Change in Core Flexible Price Peaked in Summer of 2021 and March of 2022 and Fell 7.2% in April at Annual Rate

Conclusion

We conclude the Federal Reserve opinion that the current rise in inflation is too high, and the forecast for a peak in inflation in 2022 which will recede by 2023, is correct, and the Fed can engineer a soft landing.

1 Renaissance Marco Research

as reported by Fundstrat on May 13, 2022

2 Tom Lee’s FSInsight, of Fundstrat, April 13, 2022

3 EIA expects crude oil prices higher than $100 per barrel in coming months

4 What If Goldman Is Wrong and a Lonely Oil Bear Is Right?

5 Citicorp’s Ed Morse interview on CNBC Fast Money

Let IDC provide you the value and financial history of your favorite bank stock. For you to better understand our process of valuation, we offer a free, one-time analysis of one of the 202 banks in our bank analysis database. Simply send your request with the bank stock symbol to info@idcfp.com.

To view all our products and services please visit our website www.idcfp.com. For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director