Inflation Decelerates in Second Half of 2022

Chief U.S. Economist Michael Feroli of JP Morgan expects that headliner CPI will step down from a blistering pace of 9.5% annual rate in the first half of 2022 to an elevated 7.2% in 2022Q3 and a subdued 1.7% in 2022Q4. Core CPI inflation moderates from 6.3% in the first half of 2022 to 3.3% in the second half of 2022. Consumer demand imbalances associated with earlier stages of the pandemic and easing in supply-chain pressures will contribute noticeably to the late-year deceleration.

Goldman Sachs sees CPI year-over-year around 8% in 2022Q3 and falling towards 6.8% by 2022Q4. Year-over-year core PCE inflation is forecast to fall to 4% by December 2022. Goldman Sachs on June 16, 2022, further noted that global shipments of automotive microchips had already returned to within 95% of pre-pandemic trends before China lockdowns, up 56% in 2022Q2. Additionally, there is a surge in capex by chipmakers, suggesting an increase to above-trend output later this year.

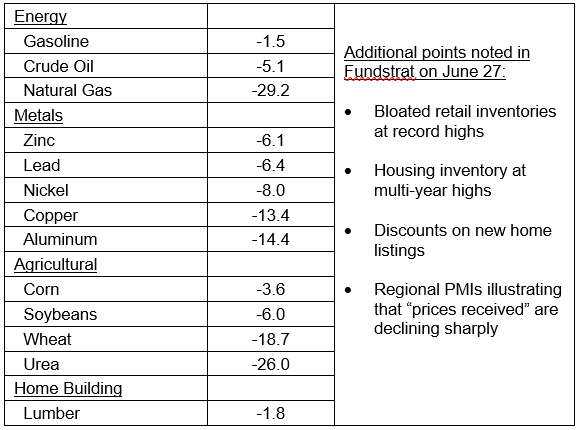

Table I

Leading Indicators of Inflation

Percent Decline from 5/24/2022 to 6/20/2022

The Current and Future State of Crude Oil and Gas Prices

Over 70% of the increase in May wholesale prices can be traced to a 5% advance in energy prices. Consumer’s concerns over inflation are likely 100% related to high gasoline prices. This article takes a closer view of these issues.

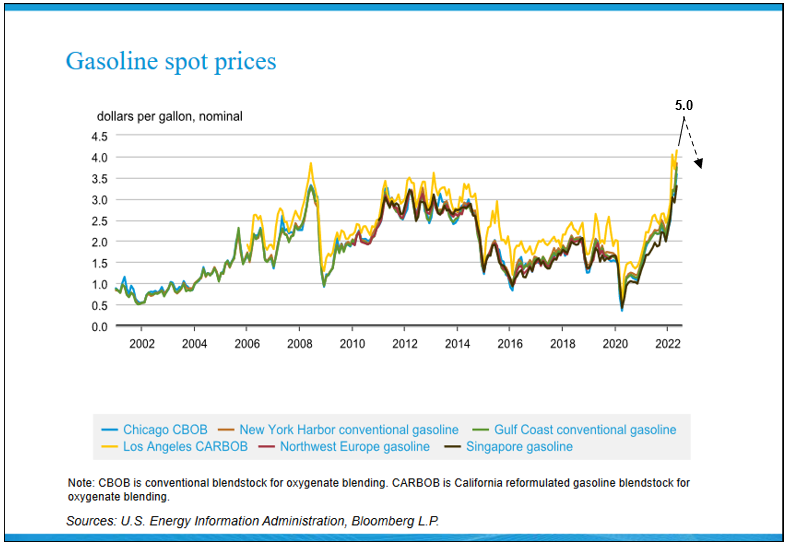

Gasoline prices continue to spike, with the average price over the $5-mark as of Monday, according to EIA data. As a result, households are already driving less and shifting focus to smaller, more fuel-efficient vehicles, hybrids and EVs, spreading even more gasoline demand destruction.1

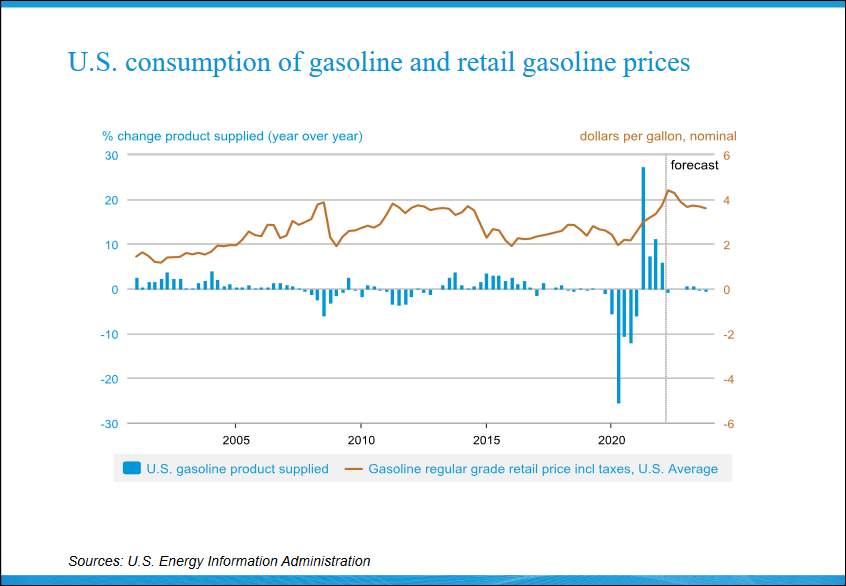

The EIA measures gasoline consumption in terms of barrels supplied to the market by refiners and blenders, not by gas station retail sales. Consumption at the end of 2021 was above levels compared to three years earlier, but in the first half of 2022, consumption has consistently been lower than the first half of 2019, well before the pandemic hit and shifted everything.1

In 2020 gasoline prices started to rise, then prices hit multiple highs in May 2021 and continued rising. In 2022 prices began to spike, hitting the magic number and suddenly gasoline consumption dropped (see Chart V). Even with summer driving season here, gasoline consumption has been rising more slowly than compared to 2019.1

So, the question remains, when will demand destruction be big enough to affect a decline in gas prices?

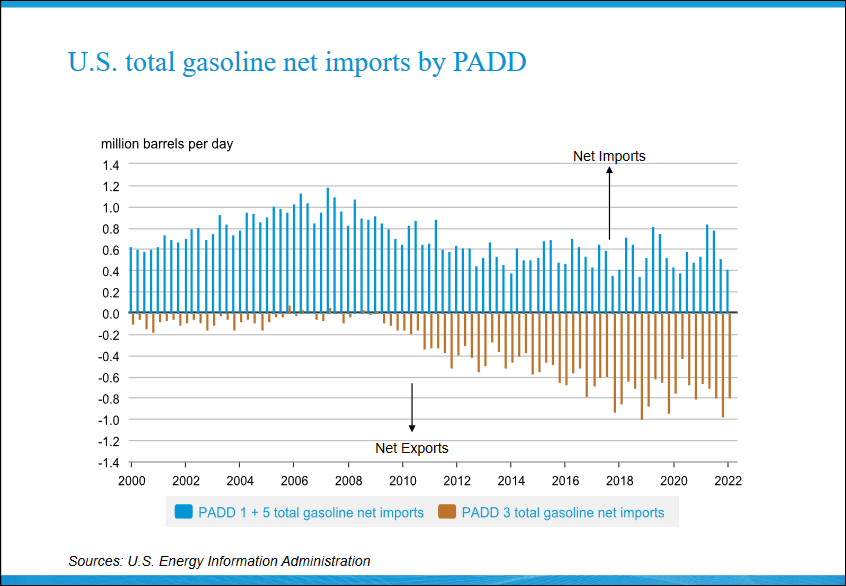

The answer is complicated by large-scale exports of gasoline by the U.S. to other countries, currently running at over 900,000 barrels per day and accounting for about 10% of U.S. domestic consumption. Even if consumption by the U.S. continues to decline, higher exports and foreign demand would counter it.1

However, if demand destruction in the U.S. is sustained and supported by demand destruction in other countries, both could have an impact and move the needle. Exports tend to be seasonal, usually peaking over the winter and dropping in spring and summer, however, over the past 3 months, exports have been up to 40% higher compared to a year ago.1 (See Chart VIII)

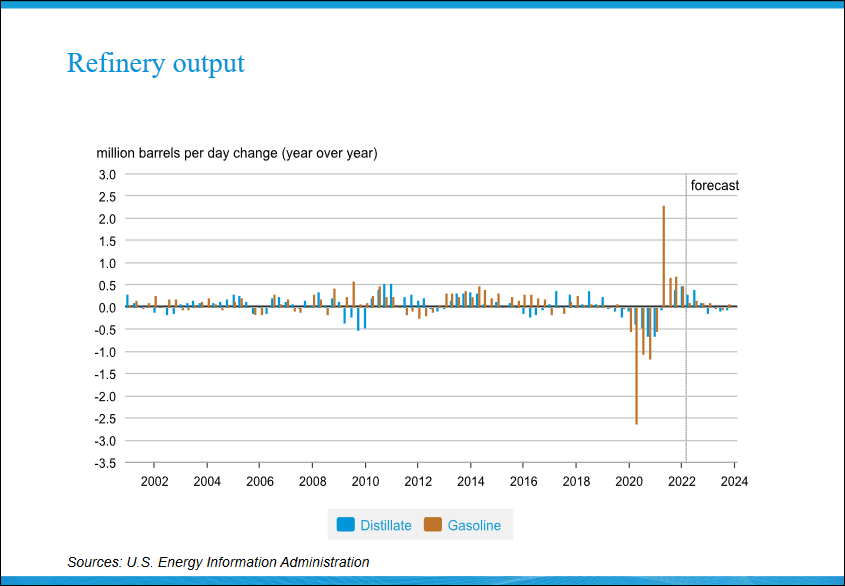

Gasoline demand is certainly on the decline and being helped by consumers purchasing smaller vehicles and those powered by electricity, but the gasoline industry has also been preparing for it. Investments in refineries are not the priority and the industry has been keeping supply tight to manage declines in gasoline consumption.1

In addition, permits for new refineries are difficult to get, as are the pipelines to transport more crude. Despite the Federal government’s attempt to limit energy investment “Exxon increased production in the Permian Basin by 70%, or 190,000 barrels per day, between 2019 and 2021, and expect to increase production by another 25% in 2022. Exxon is spending 50% more in capital expenditures in the Permian in 2022 vs 2021 and increased refining capacity to process U.S. light crude by about 250,000 barrels per day – the equivalent of adding a medium sized refinery.”2

How High U.S. Fuel Exports are Contributing to Higher Gas Prices

Shipments of gasoline, diesel and natural gas are draining already-low inventories and raising prices for U.S. consumers and companies.

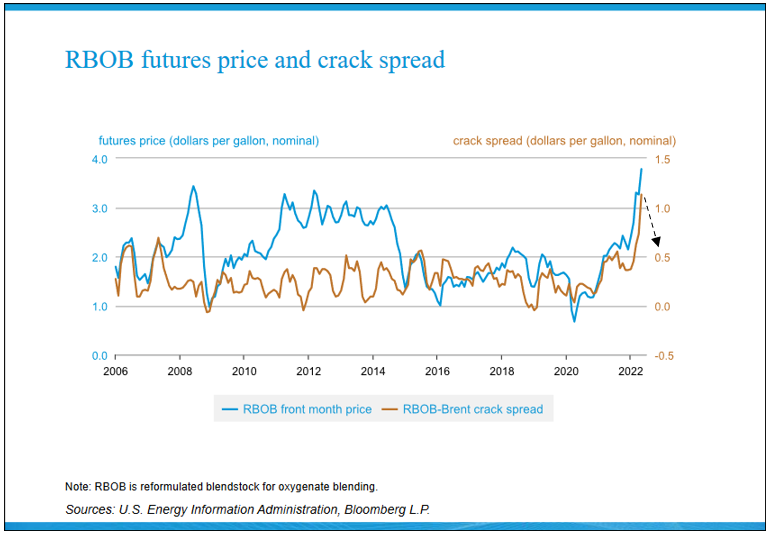

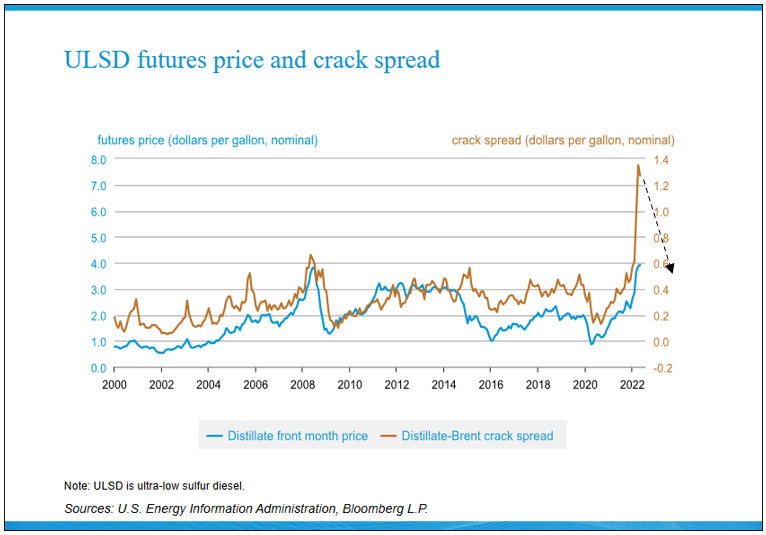

Since Russia's invasion of Ukraine in late February, U.S. gasoline and heating futures gains have outpaced gains in U.S. crude futures, as export demand boosts fuel prices. Brent crude has surged more than 50% year to date as a result of ongoing sanctions against Russia.

Traders have shipped more U.S. gasoline and diesel to Latin America and other foreign markets in recent months, reaping higher prices than the fuel could fetch domestically.3

The Story of Available Crude Oil

While factory output fell in May, oil and gas well drilling advanced 6.2%, and 57.2% higher than a year earlier. But to augment crude supplies, the U.S. released crude from the U.S. Strategic Petroleum Reserve (SPR).

By October, the SPR will shrink to a 40-year low of 358 million barrels (down 50% from the peak in 2010), as the White House taps it to put a lid on global oil prices. A year ago, the reserve held 621 million barrels.

Broadly speaking, the SPR contains two kinds of crude: medium/sour and light/sweet (oil density/sulfur content). Typically, U.S. refiners prefer medium/sour crude, which is denser and has more sulfur content, but it is also a variety the refiners can easily process into gasoline and other products, thanks to highly sophisticated processing plants. For that reason, the White House has prioritized the sale of medium/sour barrels, fulfilling the refiners’ appetite for their favorite crude. Over the last year 85% of oil the SPR sold has been medium/sour and expanding crude supplies, which, in turn, requires replenishing the SPR and the reason for President Biden’s visit to Saudi Arabia.

Delays in Iran Sanctions Relief

The delay in Iran sanctions relief is a main factor in raising price forecasts and tightening market balances, according to Citi. Previously, Iran sanctions relief were expected to add supply in mid-2022, but that relief is now projected to begin in the first quarter of 2023. 4

Citing these resulting tighter market balances, Citi raised second quarter price forecast to $113, and third and fourth quarter prices to $99 and $85, respectively. Benchmark Brent crude futures were up at about $120 a barrel, but following those price spikes, a downward trend is occurring.4

Reduction in Oil Demand

As fears of a recession looms, the overvaluation of Brent crude oil should correct and fall significantly, according to Citi’s global head of commodity research Ed Morse.5 Peaking at the exaggerated $120 range, it should be near $85 by year-end.

The expectations for reduced oil demand are echoed by Morse and Citi, as demand increase year over year was expected to be around 3.6 million barrels a day and is down to 2.2 million barrels a day, primarily due to weakness in petrochemical demand. Citi’s outlook is in the middle of the range of demand forecasts for 2022.

Focus on Supply and Demand and OPEC+

It’s ironic that just as global central banks raise interest rates to fight oil-boosted inflation, OPEC+ faces the same problem policy makers faced when they loosened monetary conditions.

For the last year, the oil cartel has been injecting liquidity and boosting output in a series of pre-planned hikes, but, by the final planned boost in August, OPEC+ will be running out of spare production capacity. The final monthly hike would boost August production back to pre-Covid levels on paper, but, in reality, output is lower because of Russian sanctions.6

Pre-planned hikes are set to end in August, though the OPEC+ deal doesn’t expire until December, so it is believed there should be another online gathering to determine output in September. While Biden is scheduled to visit Saudi Arabia in mid-July, the trip may have a lesser impact on OPEC+ deliberations.6

The cartel is focusing on supply and demand, and looking to the 2023 market outlook, scheduled to be announced on July 12, as its key input. That forecast is likely to show a bullish outlook, despite recession fears, forecasting growing oil demand by at least 1.5 million barrels a day in 2023, but down from 2.2 million in 2022.6

Yet, hiking production is becoming difficult and both traders and investors are skeptical about production capability and capacity. What matters to the oil market is not how much real capacity is left, but how much the market believes is left.

So, the question for OPEC+ becomes how to manage that spare capacity – both real and perceived.

Some believe the group should put most of its spare capacity in the market now in order to prevent triple-digit oil prices prompting recession inducing interest rate increases, and that lower oil prices are the consequence for healthier economic growth in 2023. Others disagree and believe OPEC+ must keep hold of enough to offer insurance down the line in case of supply or processing disruptions, arguing that increased supply may not subdue fuel prices like in the past.6

Chart I

Peak in Gasoline Prices

Chart II

Peak in Distillate Prices

Chart III

Peak in RBOB Crack Spread Followed by Decline to Normal Levels

Chart IV

Distillate Crack Spread Declines to Normal Levels

Chart V

Post Covid Demand Falls and Gasoline Consumption Declines to Zero Growth

Chart VI

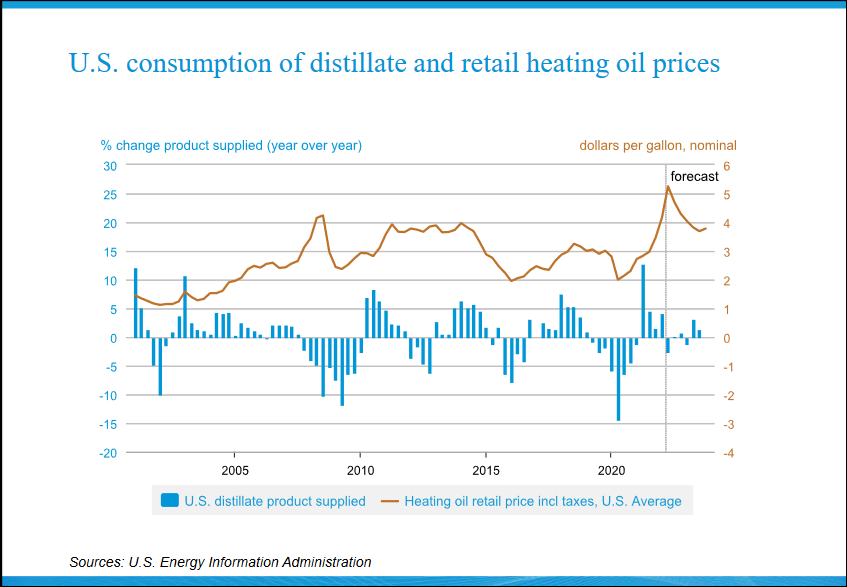

Distillate Consumption Levels Off

Chart VII

Post Covid Demand Levels Off and Refinery Output Declines to Zero Growth

Chart VIII

The Problem: Net Exports Exceed Net Imports, Elevating Gasoline Prices

Chart IX

The Bigger Problem: Net Exports by Far Exceed Net Imports of U.S. Distillate Fuel

1 As Gasoline Prices Spike, Demand Destruction Spreads Wolf Street

2 Chevron, ExxonMobil CEOs Set The Stage For Thursday Meeting With Biden Officials Forbes

3 High Fuel Exports Are Contribting to Over $5 a Gallon Gas Wall Street Journal

4 Citi raises oil price forecasts on "heavily delayed" Iran deal Reuters

5 Citi says oil should be around $70 as demand drops and recession looms Business Insider

6 OPEC+ Mulls When to Fire Its Last Oil Production Bullets, Bloomberg Opinion

To view all our products and services please visit our website www.idcfp.com. For more information on banks with brokered CDs outstanding, and the amount of these CDs, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director