Early Warning Signs from Negative Balance Sheet Cash Flow

IDC Financial Publishing (IDCFP) measures two different time series in balance sheet cash flow (BSCF) as a percent of Tier I capital.

- Quarter-to-quarter change in balance sheet cash flow percent Tier I capital.

- Year-over-year change in balance sheet cash flow percent Tier I capital.

Balance sheet cash flow equals the operating cash flow less financial cash flow, determined by changes in the balance sheet. If one is more negative than the other, or both are negative, then balance sheet cash flow is negative.

Banks with Continuous Negative BSCF Over Five or More Quarters

The 115 banks with continuous negative quarter-to-quarter BSCF over five or more quarters created risk to Tier I capital. Out of the 115 banks downgraded, 25 were reduced in ranks from 125 or above to less than 125, or below investment grade.

Banks with Continuous Negative BSCF Over Four Quarters

Banks with continuous negative quarter-to-quarter BSCF over four quarters provide an early warning sign for future deterioration of the balance sheet and risk to Tier I capital. Banks with resulting rank reductions totaled 127, with 23 banks that were ranked 125 or above now ranked below 125.

The Warning Signs at Silvergate

Silvergate Bank had negative quarter-to-quarter change in BSCF for seven consecutive quarters. As of December 31, 2022, BSCF measured over the one-year period was -287% of its Tier I capital.

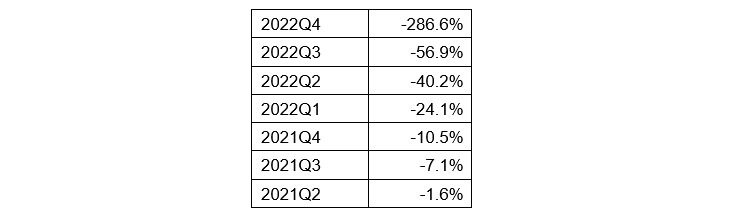

Silvergate Bank owned by the Silvergate Capital, experienced deteriorating negative balance sheet cash flow, as a percent of tangible equity capital, since 2021Q2 (see Table I). Continuous negative balance sheet cash flow drains capital and creates risk to solvency given capital ratios are close to regulatory limits.

Table I

Balance Sheet Cash Flow Percent Tier I Capital for Silvergate Bank Year-to-Year Comparison

Combining Reductions in Rank of Financial Safety

Beginning with the first quarter of 2023 bank data, to be published in May 2023, IDCFP will reduce the rank of financial ratios with four or more consecutive negative quarter-to-quarter changes in BSCF percent Tier I capital, by the amount of negative year-to-year change in BSCF percent Tier I for the most recent year period. The rank reduction is limited to -100 for five or more consecutive quarters and limited to -50 for a four-quarter period.

In addition, in May 2023, the uninsured liability as a percent of the market value of assets available for liquidation times the ratio of unrealized loss on securities held to maturity to tangible common equity capital creates the second rank reduction. We discussed the rank reductions as illustrated by Silicon Valley Bank and its risk to bank liquidity in this previous article from March 27, 2023. Together, the two proforma rank reductions occurred on 538 banks, with 47 of these declining from a rank of 125 or above to less than 125 or below investment grade.

The proforma rank changes, based on fourth quarter 2022 filings, reduced ranks of 538 banks out of 4,750 total banks reviewed by IDCFP. This is hardly a banking crisis, particularly since only 47 of the 538 banks were downgraded below 125.

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director