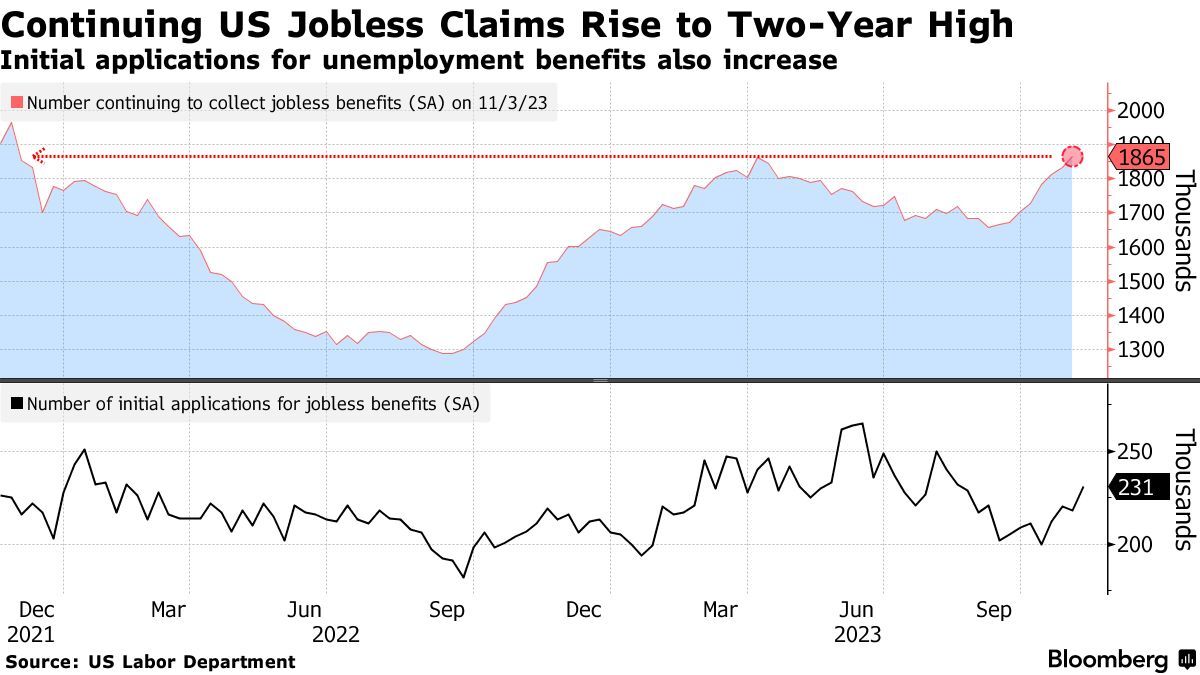

Continuing Jobless Claims Continue to Rise

Continuing applications for U.S. unemployment benefits rose to the highest level in almost two years this month, underscoring the difficulty unemployed workers are facing in finding new jobs.1

Recurring jobless claims represent the number of people continuously receiving unemployment benefits. The number of recurring applications jumped to 1.87 million in the week ended Nov. 4, according to Labor Department data out Thursday and was the eighth straight week of increases (see Chart I).1

Chart I

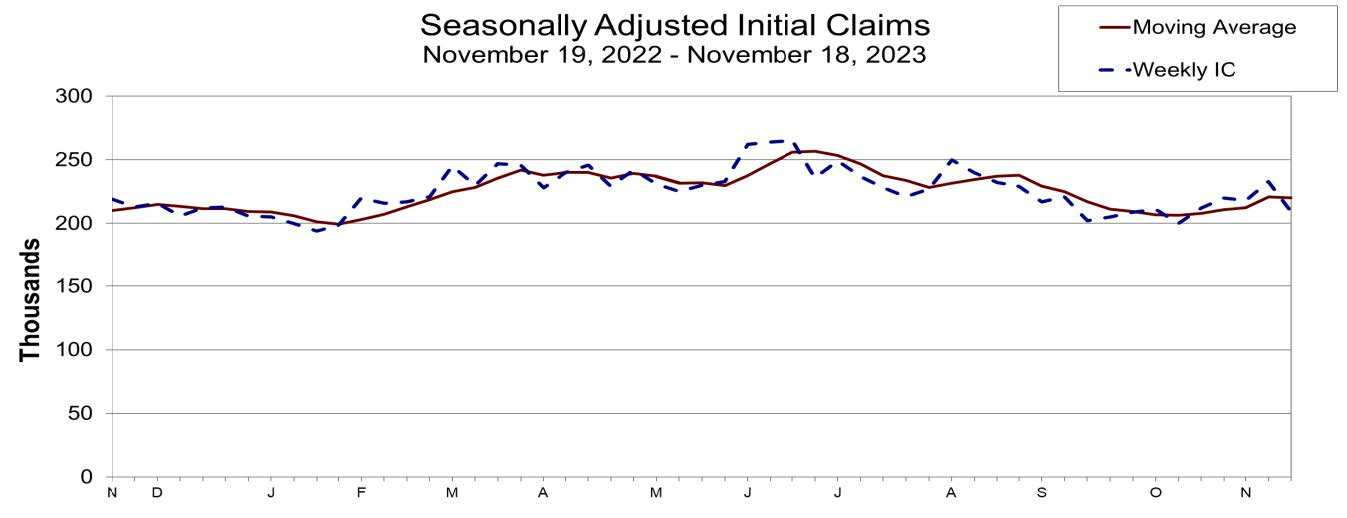

In the week ending November 18, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 24,000 from the previous week's revised level. The previous week's level, ending November 11, was revised up by 2,000 from 231,000 to 233,000. The 4-week moving average was 220,000, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 220,250 to 220,750 (see Chart II). 2

Chart II

Initial and continuous unemployment claims fell around 20,000 in this latest week. Next week’s data will be shortened due to the Thanksgiving holiday.

Although it’s difficult to draw conclusions from volatile weekly numbers, the rise in jobless claims, combined with other data, indicate some cooling in the labor market, in price pressures and in consumer spending.1

While a resilient labor market has been supporting economic growth this year, many economists expect it to lose steam under the weight of higher borrowing costs. Companies are now adding jobs at a slower pace, unemployment is rising and wage growth has decelerated, leading to some pullback in spending ahead of the holiday season.1

Eliza Winger, economist, stated “The jump in initial claims, combined with the persistent rise in continuing claims, is translating to a durable softening in the labor market. The report signals the unemployment rate is on track to edge higher in November from 3.9% in October, signaling the Fed is done hiking rates this year.”1

In an article published earlier this month by IDCFP, we discussed the Sahm rule, which signals the start of a recession when the 3-month moving average of the unemployment rate rises by 0.5% above the 12-month low of the unemployment rate. In order to indicate the beginning of a recession, the unemployment rate would be required to report 3.9% or higher for two more consecutive months.

Claudia Sahm also posted recently that while the unemployment rate reaching 3.9% is not good, the Sahm rule, currently at 0.33%, “did not trigger…nor is it right on the edge,” In addition, she states the rule has “triggered *within* 3 months of prior recessions.”

There will be key indicators in Friday’s employment report from the Bureau of Labor Statistics if unemployment rate remains 3.9% or higher.

1 – US Continuing Jobless Claims Rise to Highest in Almost Two Years, Bloomberg, 11/16/2023

2 - News Release, U.S. Department of Labor, 11/22/2023

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director