Inflation to Exceed Expectations

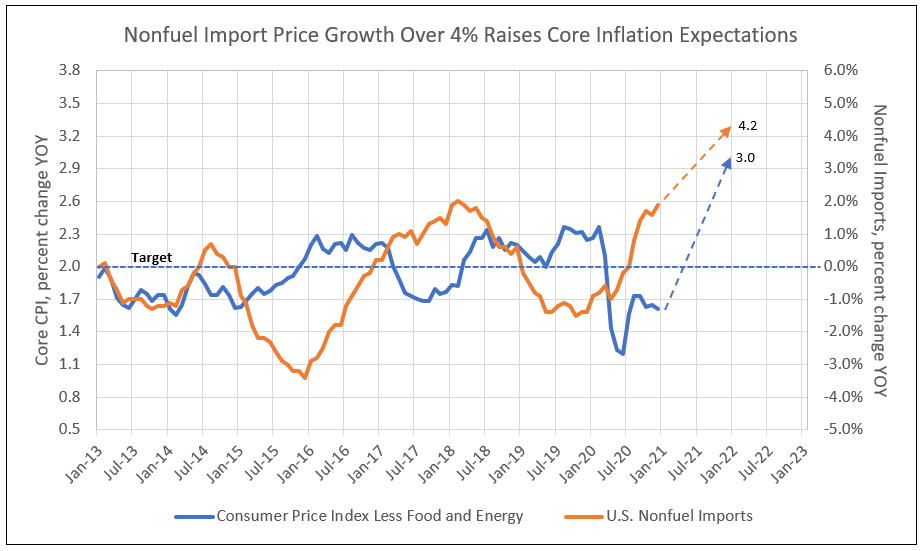

In the post-COVID-19 period, import prices provide the best forecast of inflation. As seen in Chart I, the percent growth in U.S. non-fuel import prices forecast U.S. core CPI. Since U.S. inflation is measured by year over year growth, the low registered in the 2nd quarter of 2020 provides a sharp recovery in the core CPI forecast for the 2nd quarter of 2021. This recovery in core inflation becomes more problematic with the continuing sharp rise in U.S. non-fuel import price growth in 2021.

Chart I

Non-fuel import price growth is expected to exceed 4% due to high demand for goods and shortage of supply from domestic and foreign sources post-Covid-19 (see Chart I). Increases in U.S. core inflation to well over the 2.2% historic highs of recent years, raises 10- and 30-year U.S. bond yields to unexpected high levels, and creates a bear market in bond prices.

Extracting implied inflation expectations from TIPS1

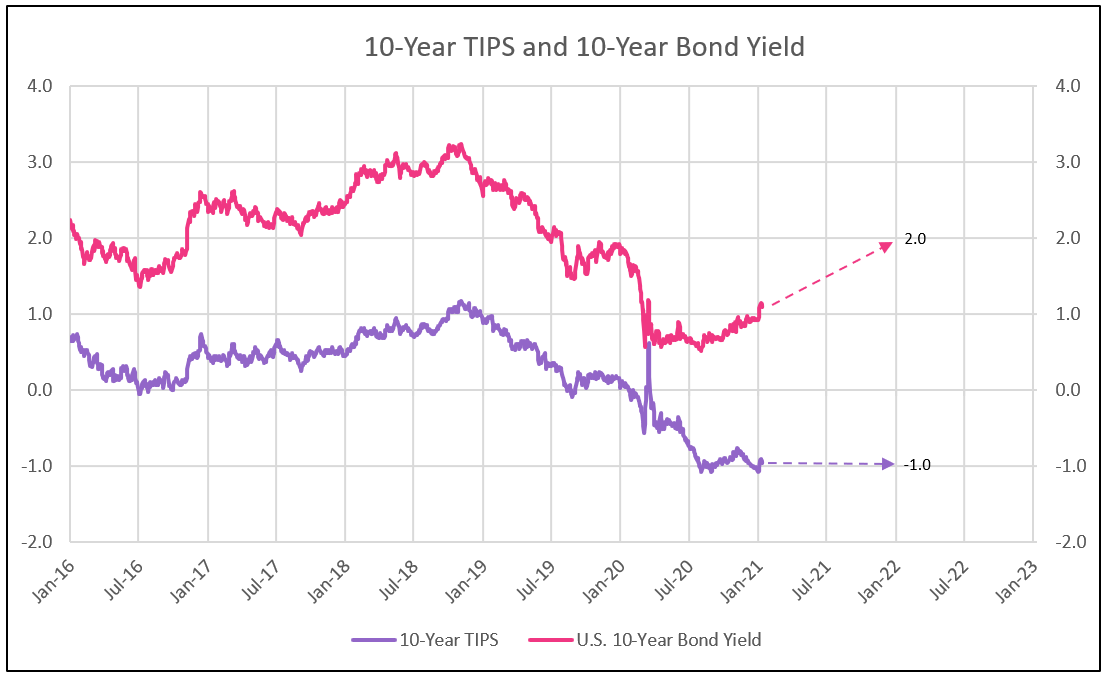

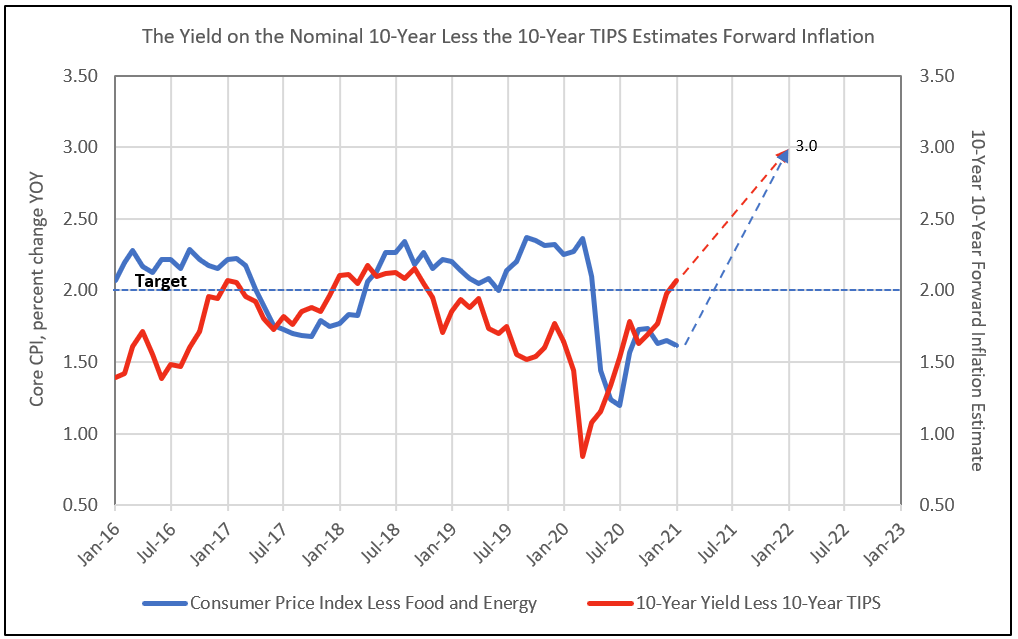

“In principle, comparing the yields between conventional Treasury securities and TIPS can provide a useful measure of the market’s expectation of future CPI inflation. At a basic level, the yield-to-maturity on a conventional Treasury bond that pays its holder a fixed nominal coupon and principal must compensate the investor for future inflation. Thus, this nominal yield includes two components: the real rate of interest and the inflation compensation over the maturity horizon of the bond. For TIPS, the coupons and principal rise and fall with the CPI, so the yield includes only the real rate of interest. Therefore, the difference, roughly speaking, between the two yields reflects the inflation compensation over that maturity horizon.”1 (See Charts II and III).

Chart II

Chart III

IDC Financial Publishing (IDCFP) expects the current 10-year forward implied inflation rate of 2.10% to rise to 3.0% in 2021 as anticipated inflation responds to rising import and raw material prices (see Chart III). The Federal Reserve has stated inflation can run above target for a short period but will not let the increase get too hot. In addition, Richard Clarida, Vice Chairman of the Federal Reserve recently declared there will be no rate hike until inflation is 2% or above for a least one year.

Similarities in Germany

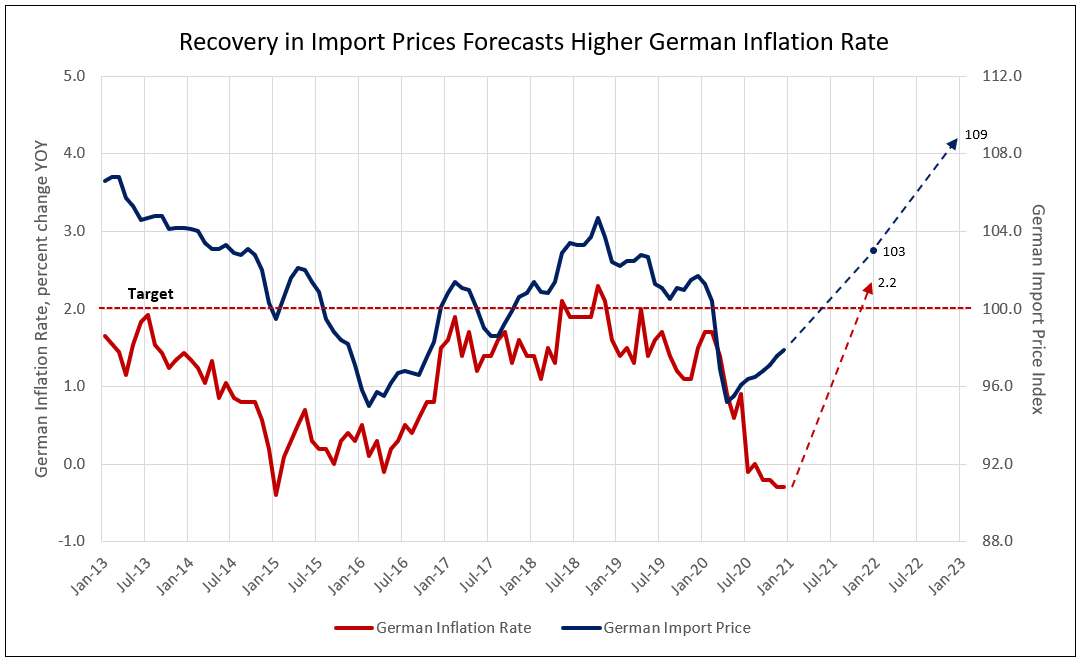

A similar event is occurring in Germany with the index of import prices recovering from 2nd quarter 2020 lows, to forecast positive readings of 103 in 2021 and 109 in 2022 (see Chart IV). Historically in 2016 and 2017, import prices at 100 or higher drove German inflation to its target of 2%, and the German 10-year yield increased to its peak of 0.8% in early 2018 (see Chart V).

Chart IV

With the index of German import prices forecast to reach 103 in 2021, German inflation will recover to over 2% or above. The German 10-year yield will not remain at -0.55% and the rise to zero or as high as +0.3% which, in turn, drives the US 10-year yields toward 2.0%.

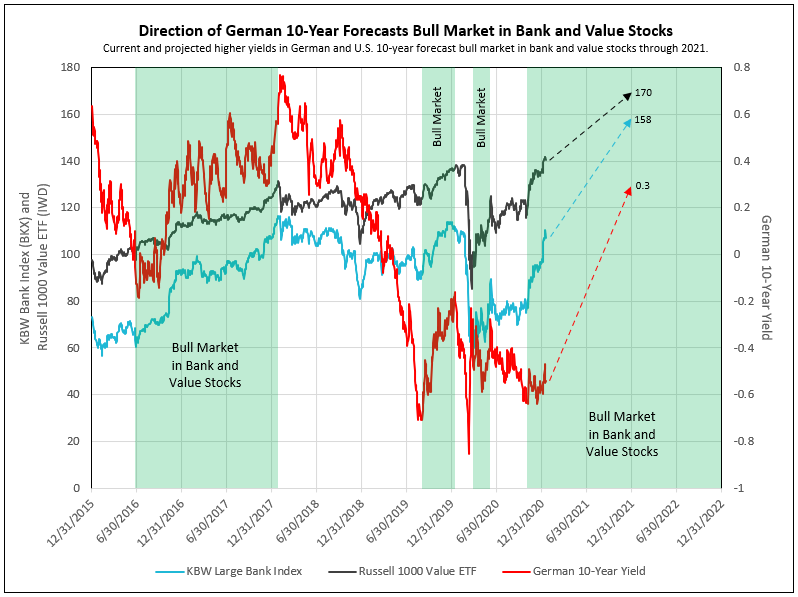

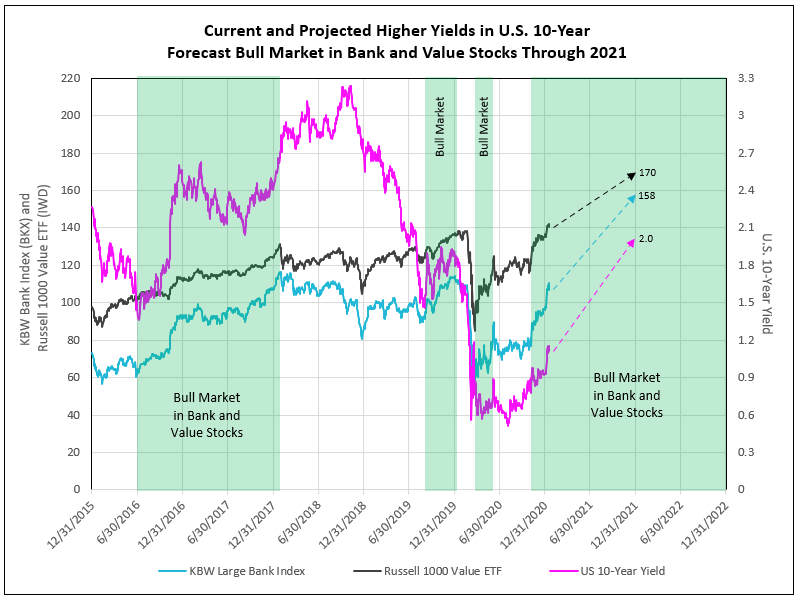

Why German Yield Trends are Key to Understanding Bull Markets in Bank and Value Stocks

- The bull market in bank and value stocks from June 2016 to February 2018 occurred during a period of rising German 10-year yields from -0.2% to +0.8%.

- With the advent of U.S. tariffs on China and Europe exports, German yields abruptly peaked in February 2018 and declined to their low in August 2019. Bank and value stocks under-performed and absolutely declined.

- The bottom in the German 10-year yield at -0.7% and the rise to over -0.2% created another short-term bull market from August to November 2019, but the advent of COVID-19 created a downdraft in bank and value stocks in the first quarter of 2020. These stocks recovered from March 23rd to June 6th, 2020 but the German 10-year failed to support this recovery, turning more negative after June 6. Bank and value stocks retreated again in August 2020.

- The latest bull market began in August and is expected to continue in 2021 and into 2022 (see Chart V).

Chart V

Bank Stock Forecast

There are several contributing factors driving future U.S. bank stock performance. These include a rising U.S. 10-Year treasury yield to as high as 2.0% under a Biden administration with Yellen as Treasury Secretary, a widening yield curve, favorable operating earnings to be reported in January and throughout 2021, reversal of overly cautious loan loss provisions under CELA adding to operating earnings, and the return of stock buybacks.

With the lack of full employment in the U.S. economy, it is a reasonable to expect the U.S. 10-year yield to increase to 2.0% in 2021. As important is the significant increase to the 30-year bond yield toward 3.0% or above by year-end 2021. Bank stocks will outperform value stocks and the S&P 500 over this extended period.

Bond prices fall as yields rise, creating a major bear market in the U.S. bonds. Bank stocks that benefit from rising long-term yields, with current dividend yields near 2.75% and more than a 45% appreciation potential, remain an attractive investment alternative (see Chart VI).

For further reading on this topic, refer to the article IDC Financial Publishing (IDCFP) published on August 31, 2020, discussing the extreme undervaluation of bank stocks to their normal valuation. We forecast the potential future appreciation potential for JP Morgan and other bank stocks. Additionally, on October 19th and November 9th, 2020 we wrote about the coming bull markets in both large and regional bank stocks.

Chart VI

1 - Inflation Expectations: How the Market Speaks, FRBSF

To view all our products and services please visit our website www.idcfp.com.

For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director