Our Remarkable Record Predicting Bank Failure and Recovery

Updated for 3rd Quarter 2022 Ranks

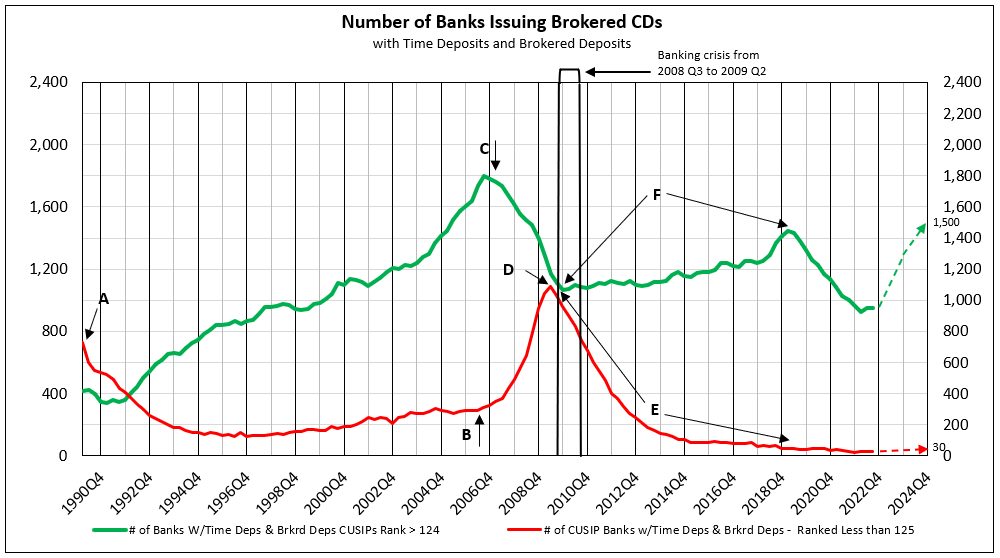

Over the next two years, we expect the number of banks issuing brokered CDs to grow, recovering in 2022 and reaching the prior high of 1500 by 2024 (see Chart I). With the dramatic rise in 2 and 5-year yields, so have the yields offered on brokered CDs increased.

IDC Financial Publishing’s Record in History

From 1990 to 2018, there were 1,419 failures of banks. Of these, 90% (1,271 banks) were ranked less than 125 by IDC Financial Publishing (IDCFP) up to 17 months before failure. Further, 73% (1,033 banks) were rated less than 125 by IDCFP up to 29 months before a collapse. The Washington State Department of Financial Institutions has listed on their website “IDC has a remarkable track record of identifying deteriorating or improving performance months, and sometimes years, before it becomes apparent to other ranking companies.” Using the group of banks which issued brokered CDs, IDCFP’s ranks not only predicted bank failure, but also forecast the larger banking crisis of 2008 to 2009.

IDCFP’s safety ratings of banks, savings institutions, credit unions range from 300 (the top grade attainable) to 1 (the lowest). From the early 1990’s, through today, institutions using our CAMEL ranks determined that ranks less than 125 were deemed below investment grade.

Chart I

IDCFP’s Ranks Forecast the Banking Crisis of 2008 - 2009

In Chart I, the red line plots the numbers of banks with an IDCFP rank less than 125. The number of these high-risk banks reached peak levels in the early 90’s (A), following the banking crisis in the late 80’s. The number of high-risk banks issuing brokered CDs then declined and stabilized at low levels until 2006.

In early 2006, the number of banks with an IDCFP rank below 125 began to accelerate (B). At the end of that same year, banks with a rank of 125 or higher, peaked at 1,800 (C) and began a decline. Together, the change in the numbers of these banks forecast, with a 2-year lead time, the crisis of 2008-2009. The peak and decline of the red line in Chart I illustrate the end of the banking crisis, and the beginning of the resolution of high-risk banks.

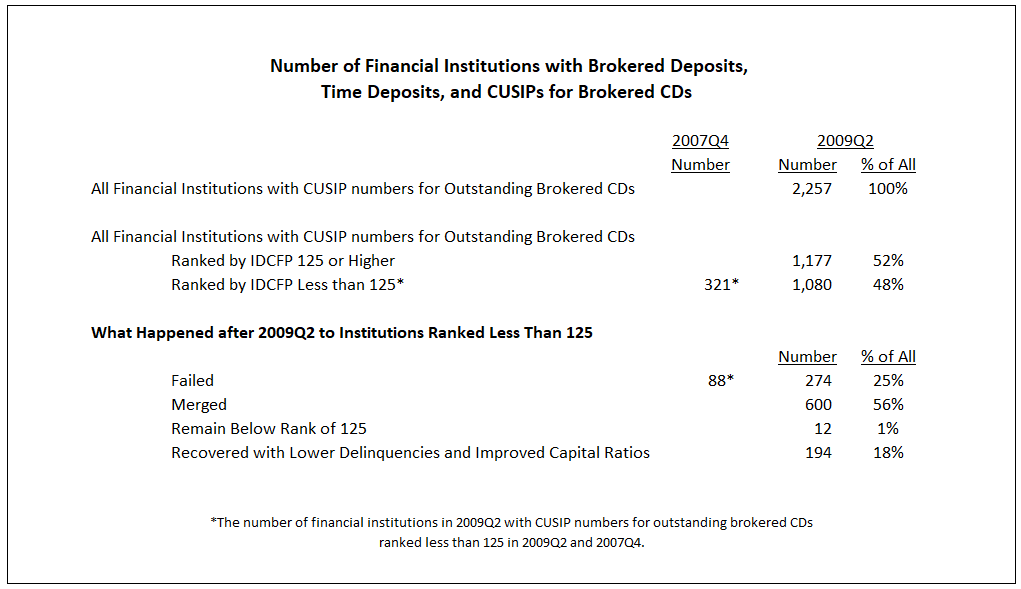

The second quarter of 2009 produced the largest number of institutions with a safety rank below 125, reaching peak level (D), also predicting the end of the crisis with a 2-year lead time. The total number of banks with brokered deposits, time deposits and CUSIP numbers for outstanding CDs numbered 2,257. Out of this total, 1,177 (52%) banks were ranked 125 or higher, and 1,080 (48%) were ranked less than 125.

Out of the 1,080 high-risk banks, 274 (25%) failed, 600 (56%) merged, 12 (1%) currently remain below investment grade, and 194 (18%) recovered, attaining a rank of 125 or above due to reduced delinquencies or improved capital ratios as of the 3rd quarter of 2022 (see Table I).

Table I

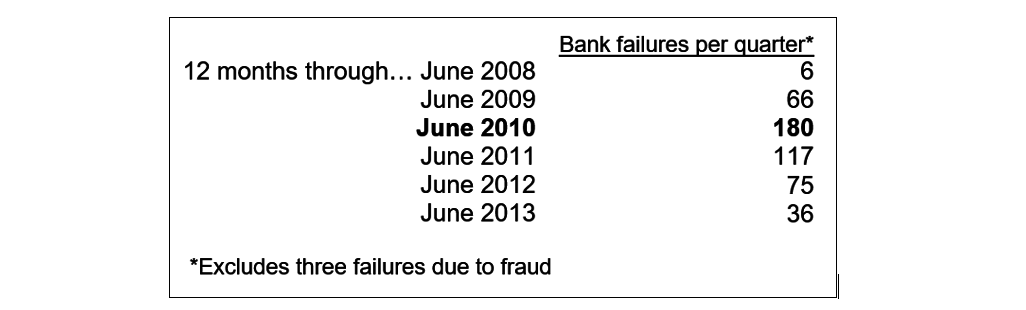

Table II below shows the number of bank failures continued to accelerate until June 2010, following the peak of institutions ranked less than 125 in 2009 by IDCFP.

Table II

Select Bank Mergers Improve Financials

From June 2009 to June 2022, a total of 600 institutions merged. Of these, 415 institutions merged into surviving institutions ranked 125 or higher. The low institution ranks were published prior to the merger, therefore a measure of high risk. As a result, the merged institutions not only survived, but also benefited. Our rank of those banks, with CDs in existence or to be issued, rose from below to above investment grade.

The Importance of IDCFP’s Ranks to Monitor Institutions Post-Banking Crisis

The demand for our financial institution ranks measuring the safety and soundness of banks continued strong from 2008 and post-crisis, as banks continued to fail and merge with higher-rated surviving institutions.

- As of June 30, 2009, banks and savings institutions ranked less than 125 by IDCFP totaled 1080, or 48% of all ranked institutions (see Table I).

- Of the 1080 institutions, only 194, or 18% of institutions ranked below 125, survived failure by improving income statements and balance sheets.

- Of the 1080 institutions, 600 merged from June 2009 to September 2022. The majority of these were ranked less than 125 prior to the merger, thereby improving their rank by merging.

- Despite the peak in the number of high-risk banks in June 2009, failure of banks and savings institutions continued to accelerate into June 2010 and remained high through June 2013 (see Table II).

- Since the peak in the Banking Crisis of 2008-2010, the number of banks ranked less than 125 has declined significantly, from June 2009 to September 2019, primarily due to bank failures and mergers into higher-ranked banks.

Crisis then Recovery

The total number of banks and savings institutions issuing brokered CDs ranked over 125 in the 2nd quarter of 2009 was 1,170 and grew to a peak of 1,448 as of March 31st, 2019. Not only did the number of investment grade institutions grow by 278 in just over 10 years, but 874 institutions below investment grade (274 failures and 600 mergers) have been replaced by new banks as of 2022Q2.

The increase in the number of institutions ranked below 125 clearly predicted the banking crisis of 2008, as early as 2006 when those numbers began to rise. The peak and subsequent decline in lower-ranked institutions also forecast the end of the banking crisis in 2009. Additionally, the increase in new banks issuing brokered CDs, plus the sharp decline in number of high-risk banks, illustrated the recovery period from 2010 to mid-2019 (F, Chart I). Our ranks of banks were critical, particularly for investors in brokered CDs, during this recovery period.

IDCFP’s Outlook for the Future

In the third quarter of 2019, the number of commercial and savings banks ranked below 125 by IDCFP decline to 40 from 51, which was due to the drop in the number of banks issuing brokered CDs, which fell to 1,424 from 1,481 during the same time. The subsequent increase in banks ranked less than 125, combined with the continued decrease in institutions issuing brokered CDs, was amplified by the advent of Covid-19.

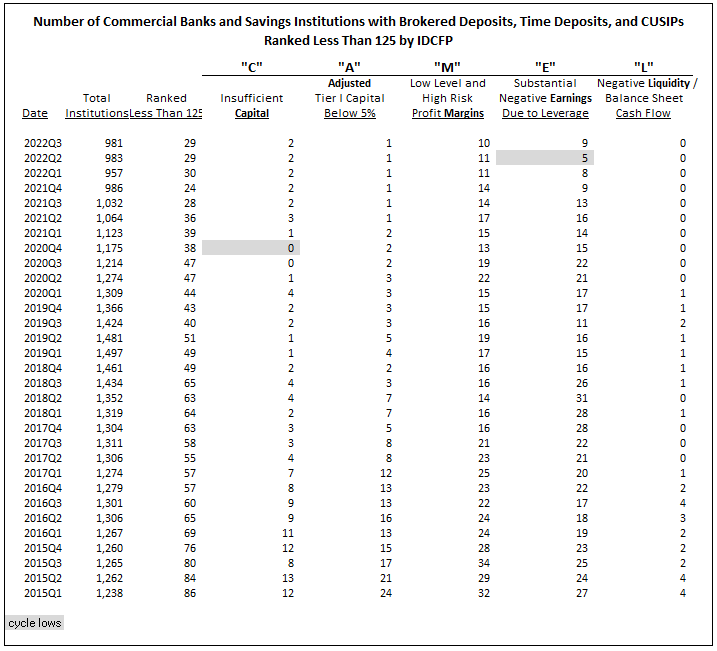

In the third quarter of 2022, the number of banks issuing brokered deposits increased and institutions ranked less than 125 remained at 29 under our CAMEL analysis (see Table III). Each category of CAMEL remained the same value or continued to decline, with the exception of institutions with substantial negative earnings (the “E” in CAMEL). There must be a sustained increase in the number of institutions ranked less than 125 in the future, as well as, in all components of CAMEL to forecast banking risk. A healthy banking environment is likely to occur and continue through 2023 as inflation peaks and moderates for the rest of the year and then substantially declines in 2023 and 2024 to the range of 2% to 3%.

Table III

Why Our Ranks are Critical for Investors and Broker-Dealers

When the number of high-risk banks again increases, so does risk to CD portfolios. The strong economy and bank deregulation drove a successful banking environment in 2019. Declining yields on U.S. Treasuries, because of tariffs in 2018-19 and the coronavirus in 2020 and 2021, reduced the number of banks issuing brokered CDs.

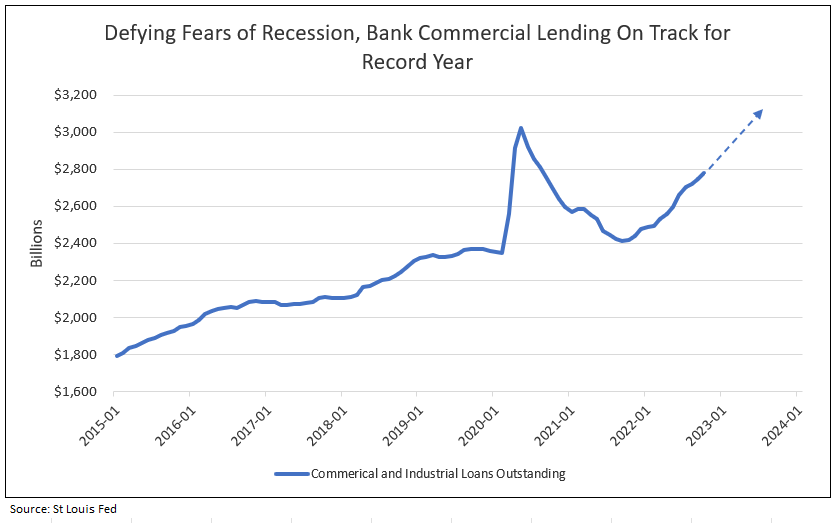

The post-Covid economic recovery with higher inflation increases loan demand, as well as, loan yields in 2022 and 2023. The dramatic rise in the yields on 2 and 5-year T-Notes raises the yields offered on brokered CDs. Therefore, the number of banks issuing brokered CDs is expected to increase the next two years, as excess liquidity decreases in the banking system. Favorable fundamentals for banks, which include commercial loan growth, strong capital positions, low loan delinquency and rising lending rates, coupled with a controlled inflationary environment, provide superior bank stock performance (see Chart II). As in the past, our ranks are critical for investors going forward to monitor the strength of financial institutions during periods of risk or growth.

Chart II

For further information or to view our products and services please feel free to visit our website at www.idcfp.com or contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director