Our Remarkable Record Predicting Bank Failure and Recovery

Updated for 1st Quarter 2023 Ranks

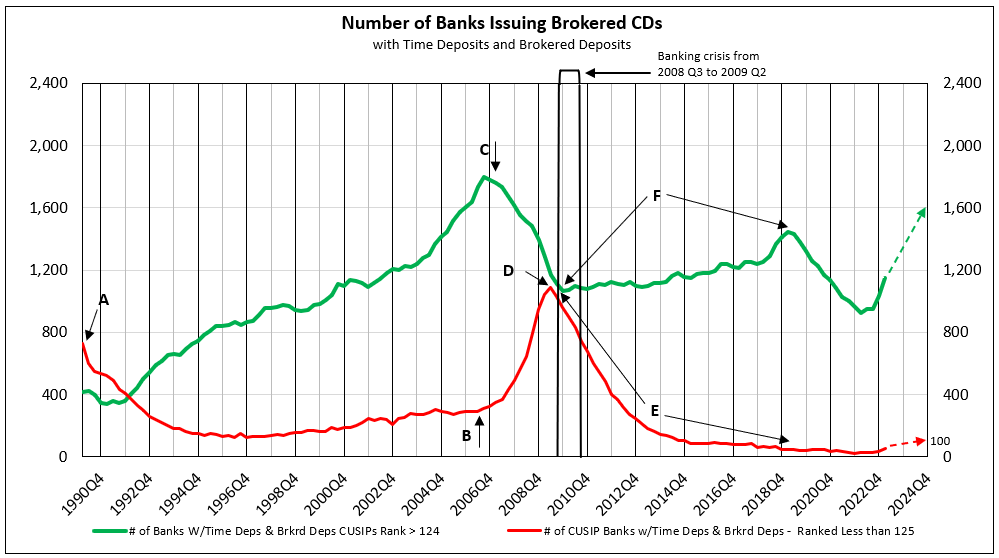

Over the next two years, we expect the number of banks issuing brokered CDs to grow to 1,600 by 2024, exceeding the prior high of 1500 (see Chart I). With the dramatic rise in 2 and 5-year yields, so have the yields offered on brokered CDs. However, banks ranked less than 125 rose in the first quarter of 2023.

IDC Financial Publishing’s Record in History

From 1990 to 2018, there were 1,419 failures of banks. Of these, 90% (1,271 banks) were ranked less than 125 by IDC Financial Publishing (IDCFP) up to 17 months before failure. Further, 73% (1,033 banks) were rated less than 125 by IDCFP up to 29 months before a collapse. Using the group of banks which issued brokered CDs, IDCFP’s ranks not only predicted bank failure, but also forecast the larger banking crisis of 2008 to 2009.

IDCFP’s safety ratings of banks, savings institutions, credit unions range from 300 (the top grade attainable) to 1 (the lowest). From the early 1990’s, through today, institutions using our CAMEL ranks determined that ranks less than 125 were deemed below investment grade.

Chart I

IDCFP’s Ranks Forecast the Banking Crisis of 2008 to 2009

In Chart I, the red line plots the numbers of banks with an IDCFP rank less than 125. The number of these high-risk banks reached peak levels in the early 90’s (A), following the banking crisis in the late 80’s. The number of high-risk banks issuing brokered CDs then declined and stabilized at low levels until 2006.

In early 2006, the number of banks with an IDCFP rank below 125 began to accelerate (B). At the end of that same year, banks with a rank of 125 or higher, peaked at 1,800 (C) and began a decline. Together, the change in the numbers of these banks forecast, with a 2-year lead time, the crisis of 2008-2009. The peak and decline of the red line in Chart I illustrate the end of the banking crisis, and the beginning of the resolution of high-risk banks.

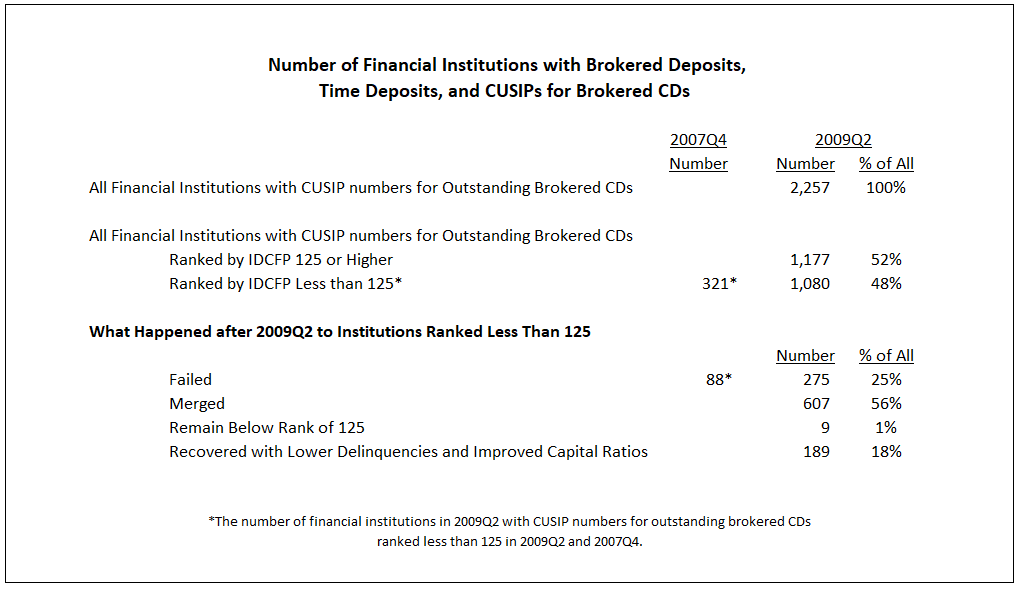

The second quarter of 2009 produced the largest number of institutions with a safety rank below 125, reaching peak level (D), also predicting the end of the crisis with a 2-year lead time. The total number of banks with brokered deposits, time deposits and CUSIP numbers for outstanding CDs numbered 2,257. Out of this total, 1,177 (52%) banks were ranked 125 or higher, and 1,080 (48%) were ranked less than 125.

Out of the 1,080 high-risk banks, 275 (25%) failed, 607 (56%) merged, 9 (1%) currently remain below investment grade, and 189 (18%) recovered, attaining a rank of 125 or above due to reduced delinquencies or improved capital ratios as of the 1st quarter of 2023 (see Table I).

Table I

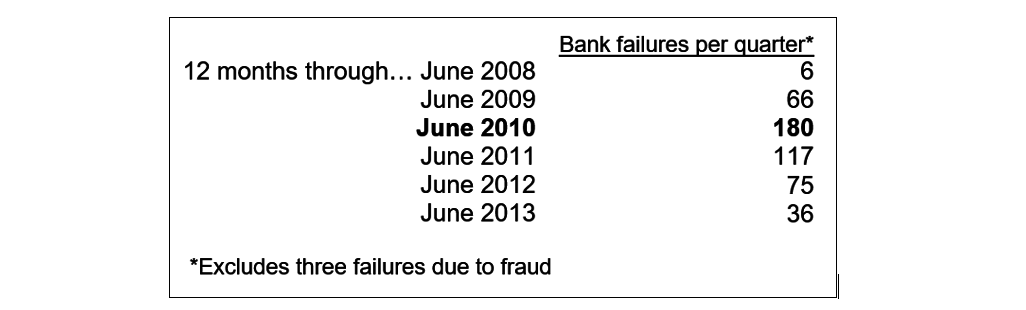

Table II below shows the number of bank failures continued to accelerate until June 2010, following the peak of institutions ranked less than 125 in 2009 by IDCFP.

Table II

Select Bank Mergers Improve Financials

From June 2009 to December 2022, a total of 607 institutions merged. Of these, 422 institutions merged into surviving institutions ranked 125 or higher. The low institution ranks were published prior to the merger, therefore a measure of high risk. As a result, the merged institutions not only survived, but also benefited. Our rank of those banks, with CDs in existence or to be issued, rose from below to above investment grade.

The Importance of IDCFP’s Ranks to Monitor Institutions Post-Banking Crisis

The demand for our financial institution ranks measuring the safety and soundness of banks continued strong from 2008 and post-crisis, as banks continued to fail and merge with higher-rated surviving institutions.

- As of June 30, 2009, banks and savings institutions ranked less than 125 by IDCFP totaled 1080, or 48% of all ranked institutions (see Table I).

- Of the 1080 institutions, only 191, or 18% of institutions ranked below 125, survived failure by improving income statements and balance sheets.

- Of the 1080 institutions, 607 merged from June 2009 to March 2023. The majority of these were ranked less than 125 prior to the merger, thereby improving their rank by merging.

- Despite the peak in the number of high-risk banks in June 2009, failure of banks and savings institutions continued to accelerate into June 2010 and remained high through June 2013 (see Table II).

- Since the peak in the Banking Crisis of 2008-2010, the number of banks ranked less than 125 has declined significantly, from June 2009 to September 2019, primarily due to bank failures and mergers into higher-ranked banks.

Crisis then Recovery

The total number of banks and savings institutions issuing brokered CDs ranked over 125 in the 2nd quarter of 2009 was 1,170 and grew to a peak of 1,448 as of March 31st, 2019. Not only did the number of investment grade institutions grow by 278 in just over 10 years, but 882 institutions below investment grade (275 failures and 607 mergers) have been replaced by new banks as of 2023Q1.

The increase in the number of institutions ranked below 125 clearly predicted the banking crisis of 2008, as early as 2006 when those numbers began to rise. The peak and subsequent decline in lower-ranked institutions also forecast the end of the banking crisis in 2009. Additionally, the increase in new banks issuing brokered CDs, plus the sharp decline in number of high-risk banks, illustrated the recovery period from 2010 to mid-2019 (F, Chart I). Our ranks of banks were critical, particularly for investors in brokered CDs, during this recovery period.

The Warning Signs Before a Financial Crisis

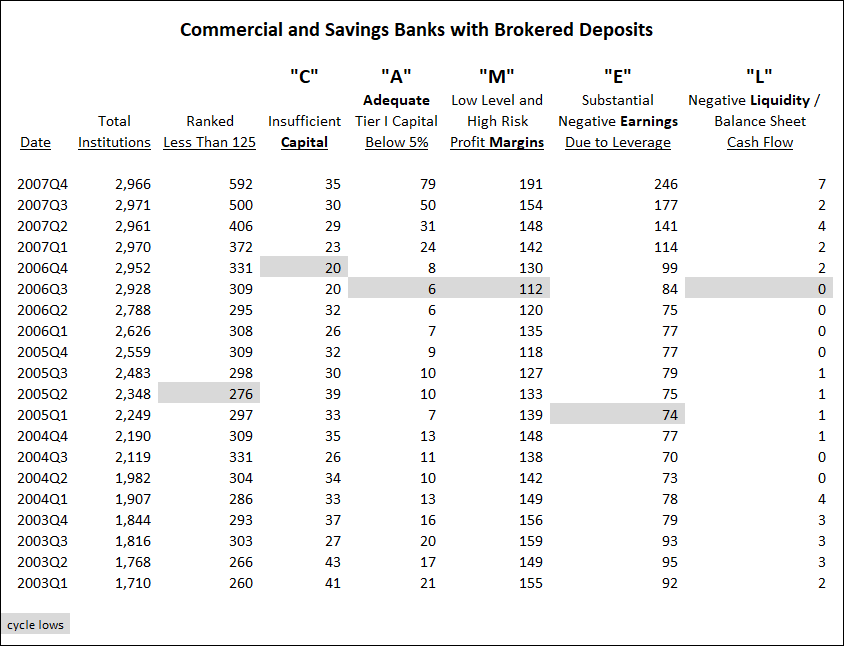

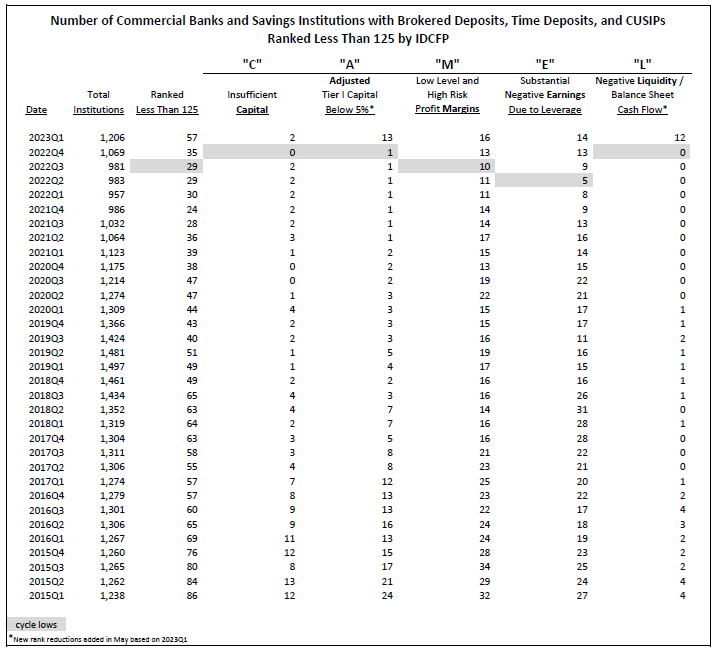

At-risk banks with brokered deposits began to rise in 2005. The number of banks with brokered deposits ranked less than 125 by IDCFP, or below investment grade, reached its low of 276 in the second quarter of 2005, then rose above that level, accelerating in 2007. This rise in banks ranked below investment grade by IDCFP signaled the financial crisis with a 3-year lead time (see Table III).

Rise in at-risk banks with brokered deposits under each component of the IDCFP’s CAMEL rank also began in 2005. Table III shows how each component of our CAMEL ranks reached cycle lows in the number of banks ranked under 125 and subsequently rose to higher numbers well in advance of the financial crisis.

- The earliest warning came from the E in CAMEL falling to 74 in the first quarter of 2005.

- In the third quarter of 2006, the A, M and L also reached lows.

- In the fourth quarter of 2006, the C in CAMEL reached its low 18 months before the financial crisis.

Table III

First Evidence of Potential Risks in Banking

There must be a sustained increase in the number of institutions ranked less than 125 in the future, as well as, in all components of CAMEL to forecast major risk to banking.

In the first quarter of 2023, the number of banks issuing brokered deposits increased and institutions ranked less than 125 rose to 57 from 35 the previous quarter, in part due to additions in our CAMEL analysis (see Table IV). Institutions with substantial negative earnings (the “E” in CAMEL) and institutions with low-level, high-risk profit margins (the “M” in CAMEL) both continued to rise in 2023Q1. Insufficient capital (the “C” in CAMEL) increased slightly. The categories of adjusted Tier I Capital (the “A” in CAMEL) and negative liquidity (the “L” in CAMEL) increased significantly in 2023Q1, due to rank reductions added by IDCFP in May (see Table IV). These rank changes reflect the reasons behind the liquidation of Silvergate Bank, CA and failure of Silicon Valley Bank, CA.

Rank Reductions

A reduction in rank due to capital ratios below 5% (captured in “A” of CAMEL) is a result of 1) excessive loan delinquency that is greater than the loan loss reserve, and, new this quarter, 2) the Tier I capital ratio, excluding the elected AOIC or unrealized losses on securities held for sale, declining below 5%.

The rank may also be reduced as a result of loan delinquency reflected in large negative balance sheet cash flow (BSCF) or, new this quarter, four or more consecutive quarters of negative BSCF. Liquidity the “L” of CAMEL) also reflects reduced ranks based on the excess of uninsured deposits and borrowings greater than the market value of assets available for liquidation. This excess percentage over 100% is multiplied by the ratio of unrealized losses on securities held to maturity to tangible common equity capital to reflect the lack of liquidity.

Table IV

Outlook for Banks

A healthy banking environment could occur in 2023 given inflation peaks and moderates and then substantially declines in 2023 and 2024 to the range of 2% to 3%. Loose financial conditions still exist despite the Fed’s tightening and a few banks collapsing. However, sticky inflation persists in 2023, and the Fed could raise the funds rate above 5.25% and maintain the increase for a longer period of time. This could result in a recession in late 2023 or early 2024 with continued deterioration in the quality of banks and an increase in the number of banks ranked less than 125, or below investment grade.

Why Our Ranks are Critical for Investors and Broker-Dealers

When the number of high-risk banks again increases, so does risk to CD portfolios. The strong economy and bank deregulation drove a successful banking environment in 2019. Declining yields on U.S. Treasuries, because of tariffs in 2018-19 and the coronavirus in 2020 and 2021, reduced the number of banks issuing brokered CDs.

The post-Covid economic recovery with higher inflation has increased loan demand, as well as, loan yields in 2022 and 2023. The dramatic rise in the yields on the 1, 2, and 5-year T-Notes raises the yields offered on brokered CDs, therefore, the number of banks issuing brokered CDs is expected to increase the next two years, as excess liquidity decreases in the banking system.

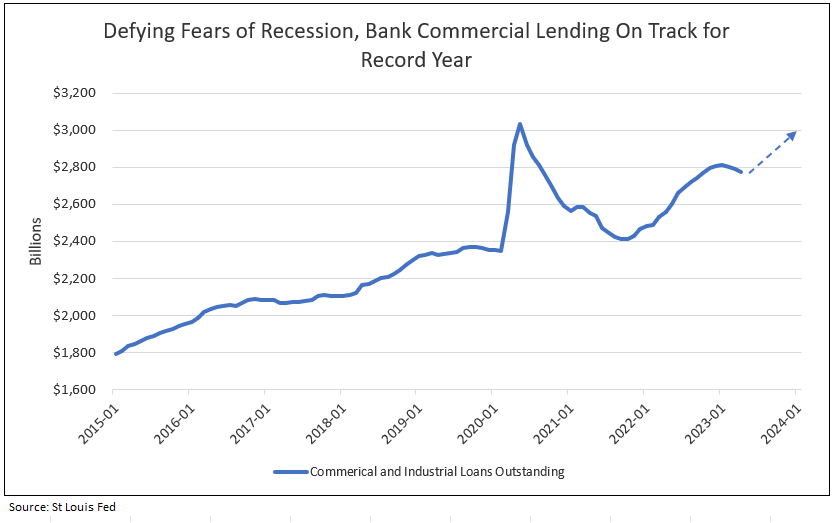

Favorable fundamentals for banks, which include commercial loan growth and strong capital positions, along with current low loan delinquency and favorable lending rates, provide support for bank stock performance (see Chart II). A recession, however, would increase loan delinquency, reduce profitability, and create risk to capital, and, in turn, increase the number of banks at risk ranked less than 125.

Chart II

As in the past, our ranks are critical for investors going forward to monitor the strength of financial institutions during periods of risk or growth.

For further information or to view our products and services please feel free to visit our website at www.idcfp.com or contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director